|

Finding affordable golf cart insurance is easy. After all, fewer accidents happen in golf carts than most any other type of motor vehicle. That's why golf cart insurance is more affordable than most all other types of toys. What you may not know is that many times you're settling for sub-standard coverage when you could be getting much better and higher coverage. For literally pennies on the dollar and sometimes at no extra cost at all, I'll show you how to maximize your coverage for a little or nothing extra in premium. So before you buy a golf cart insurance policy, make sure that you're aware of and avoid these five pitfalls: Five biggest mistakes made when buying golf cart insurance 1. Attaching your golf cart to homeowners insurance policy. Yes, this way maybe simple and very inexpensive. But the fact is, if you read the policy, you may be surprised to find out what the policy does not cover. Each homeowners insurance company attaches golf cart insurance policies a little differently. And because of that, there are some wide variances from one company/policy to the next as far as what is covered and what is not. There are several things you need to keep your eye out for with the golf cart attached to a homeowners policy:

Those are just some of the shortcomings you need to be aware of if you're attaching your golf cart to a homeowners insurance policy. But when you buy exclusive stand-alone golf cart insurance, you don't have to worry about any of those lack of coverages because with most stand-alone policies, those things are all covered. 2. Shopping with the same mentality for golf cart insurance that you would shopping for auto insurance. Keep in mind that you need to be very price conscious when you're selecting levels of coverage. The comparisons between coverage versus price are totally different for golf cart insurance then they are for auto insurance. And thus, you want to look at golf cart insurance in a different way. Some parts of auto insurance coverage are pricey enough that people reject or lower important coverages. With golf cart insurance, that is almost never the case. 3. Not comparing prices at higher coverages. This is the part where I let you in on a big secret. With most golf cart insurance policies, there's always a yearly minimum premium. That's the absolute lowest that any company will insure a golf cart for. Because golf carts are off-road vehicles and because of the chances of them being involved in a collision are very rare, it just so happens that many golf carts rate below the yearly minimum premium. What does this mean? It means that you can get a lot higher coverage than what you're being quoted for little or no extra money. 4. Not taking comprehensive and collision coverage. Many people simply select liability coverage only on a golf cart. Nine times out of 10, they're making a big mistake as far as value versus price. That's because components of a golf cart insurance policy are much cheaper than people realize! And this certainly includes comprehensive and collision coverages, even at very low deductibles. And besides physical damage coverage on the golf cart, you also do not want to pass up on uninsured motorist coverage or medical payments coverage. Both of which may not even be available on the homeowners policy. Once again this coverage is very inexpensive. I highly advise you to look into that. 5. Not being insured for accessory coverage. A lot of golf cart owners like to modify their cart in someway. If you carry physical damage coverage on the golf cart, most stand-alone golf cart insurance policies will also allow you free accessory coverage up to a certain amount (usually $3000) And you also have the option of purchasing even more coverage if need be. Once again this coverage is very inexpensive, not to mention free in most cases. But yet very few people take advantage of it. Summary: the best way to illustrate how this works is to simply show you examples of quotes I've ran in the past...... Policy A: carries low level of liability insurance (25/50/25) and nothing else..... Cost? $75 per year. .....Now let's take that exact same insured driver and set them up with policy B: Policy B: is quoted with much higher levels of liability coverage 100/300/100, also carries 100/300 uninsured motorist coverage and $10,000 worth of medical payments coverage. And it has physical damage coverage on his golf cart with both comprehensive and collision that only have $100 deductibles.... How much do you think policy B would cost per year? From my experience as an agent running golf cart insurance quotes for people, I can tell you that for the majority of people, policy B is going to be somewhere in the range of 75 and $90. That's it! That is at most only a 20% increase,and in many cases especially with older model golf carts, there's not any extra cost. I know that may sound like something a little too good to be true, but it's really not. It's simply a flaw in the rating system of how many golf cart insurance companies rate the golf carts in comparison with other types of vehicles. So take advantage of it. If you live within my six state territory, feel free to see for yourself. Click on the link below and I will run your golf cart insurance quote with companies that rate golf carts exactly like I've described. You will see for yourself the difference in value. And as always, I handle all put all quotes personally and privately. Get a Golf Cart insurance quote with Lyles Insurance Call me for a Quote Related Blog Articles: Video: Basics of a Golf Cart Insurance Policy Golf Cart Insurance in Ohio: Don’t get cheated out of great coverage and pay the same price! Golf cart insurance: 6 Key things you need to know before buying Where can I find Insurance for a Golf Cart licensed for road use? Golf cart insurance: 6 Key things you need to know before buying

0 Comments

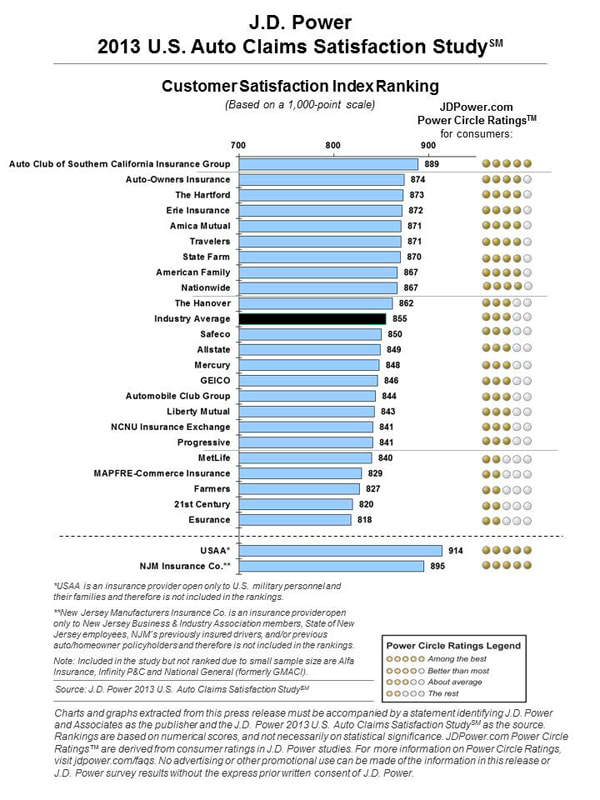

Which Auto Insurance Company is the Best at Handling Claims? The Survey Data May Surprise You!2/22/2014 If you're looking to find the best auto insurance company as far as handling claims, you might be quite a bit surprised at the results you're about to see. A lot of different things are involved when it comes to auto insurance claim satisfaction such as timeliness, customer service, meeting expectations,..... things like that. So it's important to go to a trusted credible independent source for this information. As far as the auto insurance in the industry is concerned, we are thankful to have such resources. The main source used in this study is from JD power and Associates. They publish an annual auto insurance claim satisfaction study, and their 2013 study was just released several months ago. JD power surveyed 11,500 people who'd recently filed claims within the last year. So how do the companies stack up against one another as far as handling claims? The answer is overall very well, no matter which company. See for yourself...... Key conclusions and findings:

Get an Auto Insurance Quote with Lyles Insurance Call me for a Quote  How does the random letter selection program work? The Ohio BMV selects 1500 vehicles at random every week. (***Edit: as of 2017, that number now stands at 5400) On the day that that vehicle is selected, the owner will soon get a letter in the mail stating that their vehicle was selected on that particular day. The owner then has to submit documentation to prove that they carried at least the state minimum liability auto insurance coverage on the date they were selected. Failure to do so results in a license suspension, and the driver will also have to carry an SR22 filing for three years. My vehicle that was selected was a spare. I don't drive it and I wasn't carrying liability coverage on it. What can I do? Other than the exemptions I'll get to below in a minute, there's really not anything you can do if you weren't carrying liability coverage on that vehicle on that particular day. The BMV is very strict on this, and they only grant exceptions for very valid reasons. But the bottom line is, if you own a vehicle that you're not driving, unless you turn in your tags to the BMV, you still need to carry liability coverage on it . If I cannot prove I had auto insurance on that day, how long will my license be suspended?

What exceptions will the Ohio BMV except for not having to comply with the random letter?

But other than those reasons, the Ohio BMV is pretty strict on things. If you believe you do have another valid reason for not having insurance on the on the vehicle at the time of selection, you can request a hearing. This hearing cost $30 to set up. And once again, they only except very valid reasons. I have valid insurance on the vehicle that was selected, but I can't find any paperwork. What do I do? All you simply need to do is contact your agent or insurance company, and ask for any of the following:

Once you've either served your suspension time, or applied for and was granted special work driving privileges, you'll have a few other hoops to jump through:

What is an SR22 filing? An SR22 is simply a guarantee to the state Bureau of Motor Vehicles that you're carrying at least the state minimum liability coverage. An SR22 is not insurance itself, it is simply a filing that attaches onto an auto insurance policy. With an SR22 filing, insurance companies are required by law to notify the Ohio BMV if your policy ever lapses or cancels. That is how they're going to keep dibs on you for the next three years. Once the DMV gets this notice that your SR22 is no longer in force, they will they will suspend your license again, and it will remain suspended until you put another active SR22 in place. How can I get auto insurance and an SR22 filing if I don't own a vehicle? In Ohio, there are three types of policies that could be purchased by non-vehicle owners that will satisfy the SR22 requirement. The three choices are a financial responsibility bond (this is usually the cheapest), a named operator policy (a little more expensive but higher and more coverages offered), or a broad form named driver policy (which is sort of a hybrid between the two). To learn more about the differences between these three types of policies, feel free to do a search in my blog for each of the three. I have written lots of information about them in prior blogs that help explain the differences. Get an Auto Insurance Quote with Lyles Insurance Call me for a Quote Related Blog Articles: Video: How long do you have to have an SR22 in Ohio? Video: Ohio BMV Random Letter Auto Insurance Check Video: Ohio BMV & SR22 Auto Insurance reinstatement guide 10 Keys to Buying Auto Insurance in the Portsmouth Ohio area with a bad driving record A little common sense goes a long way. It doesn't take a data-collecting study to know not to drink and drive, or not to text and drive. But to see exactly to what degree certain driving behaviors are directly responsible for traffic fatalities sheds a whole new light on how serious some of these behaviors are. The study was conducted by the National Highway Traffic Safety Administration, which is a division of the US Department of Transportation. Data was collected from both auto and motorcycle fatalities. The study identified the 13 driving behaviors that lead to the most fatalities, along with the pencentage of fatalities that each behavior was responsible for. So.... without further adieu, here's the list Driving behaviors reported for drivers and motorcycle operators involved in fatal crashes. 1. Driving too fast for conditions or in excess of posted speed limit. 20.8%. 2. Under the influence of alcohol, drugs or medication. 13.8%. 3. Failure to keep in proper lane. 9.2%. 4. Failure to yield right-of-way. 7.2%. 5. Driving distracted (phone use, talking, eating, etc.) 7.1%. 6. Operating vehicle in erratic, reckless, careless or negligent manner. 6.0% 7. Over correcting/over steering. 4.8%. 8. Failure to obey traffic signs, signals or officer. 4.2%. 9. Swerving or avoiding due to wind, slippery surface, other vehicle, object, nonmotorized in roadway, etc. 4.0%. 10. Vision obscured parentheses rain, snow, glare, lights, buildings, trees, etc. parentheses. 3.0%. 11. Driving drowsy, asleep, fatigued, ill, or blackout. 2.6%. 12. Driving wrong way and one way traffic or on wrong side of the road. 2.5. 13. Making improper turn. 2.3%. * Other factors combined for 15%. 10.5% of fatalities were unknown, and no causes were reported for 29.8% of fatal crashes. ** These numbers add up to more than 100%. That's because in some cases, there was more than one behavior that lead to a fatal crash. Get an Auto Insurance Quote with Lyles Insurance Call me for a Quote Related Blog Articles: Video: 6 ways to screw up your auto insurance rate Video: Progressive Snapshot: How I saved 11% on my auto insurance Video: 13 Deadliest Driving Behaviors  When it comes to classic car insurance, most insurance claims adjusters have little experience when it comes to accessing damage to classic cars. Even the most seasoned claims adjusters have problems with accessing true costs of repair. They're not experienced in handling claims on vehicles that maintain or appreciate in value. Nor are they experienced with knowing the difficulty in finding the right replacement parts to adequately replace a covered loss. That's why you should not insure your classic car with regular auto insurance. Yes, there are a few major auto insurance companies who insure classic / vintage autos. But you do not get the extra care that you would with insurance companies who specialize in classic cars. For examples, here are ten features found on a stand-alone classic car insurance policy that you usually won't find on a regular auto insurance policy : 1. Many regular auto insurance companies only pay claims on an actual cash value basis. For a classic car, it's important to be insured on an agreed value basis. 2. If you have a repair claim, you have much more flexibility in your choice of body shops. 3. Additional coverage available for tools,parts and accessories. 4. Excellent roadside assistance coverage that goes beyond what roadside assistance on a regular auto policy does. 5.Coverage on automobilia and equipment brought to car shows. 6. If you own multiple classic cars, you only pay one liability premium instead of paying per car as with regular auto insurance. 7. No restrictions on mileage as long as the vehicle isn't the primary driving vehicle (many companies place strict limitations on mileage for classic cars). 8. Zero deductible option available. 9. Appreciation of coverage (some vehicles will qualify for appreciation, which means the agreed value will rise instead of drop like it does with regular vehicles). 10. Enhanced towing and labor coverage. Bottom line is, if you own a very special vehicle, you need to take care of it properly. Get quotes only from those companies who specialize in classic vehicles. There are plenty of companies that specialize in classic car insurance. If you live within the states of Ohio, Michigan, Indiana, Pennsylvania, Virginia or West Virginia and would like to get a quote with just companies that specialize in classic car insurance, simply click on the link below and fill out the easy classic car insurance quote form. Get a Classic Car Insurance quote with Lyles Insurance Call me for a Quote Related Blog Articles: Classic Car Insurance in Ohio: Key points to look for in finding the best coverage  Senior drivers and older drivers can find a lot of information on the internet about ways to save money on their car insurance. However, most of the recommendations are simply either outdated and no longer true, flat out wrong, or are so miniscule in significance that they distract you away from what is important. By that I mean, expecting to find expert tips on saving money on car insurance as a senior focuses your attention towards the nickels and dimes, when you should be focusing on the dollars. I researched plenty of "informative" articles claiming to help seniors save money.Here are common ways that you will read about how to save money on auto insurance that are really more fluff and window dressing than they are real ways to save money. Bogus ways of saving money on auto insurance 1. Retiring. Many people falsely believe that changing your employment status from employed to retired saves a significant amount of money and auto insurance rates. That may have been true years ago, but not so much anymore. In fact, I have ran many experimental quotes in which I changed either the employment status from employed to retired, or change the use of the vehicle from commute to pleasure. Either way, it made zero difference on the premium. In fact, only about half of the companies even ask for questions like that when you're getting an auto insurance quote. 2. Taking adult safety courses. It is true that taking some type of mature driver safety course that is accredited through your state will give you an auto insurance discount with many companies. But the reality is that this discount is extremely minor, and you will more likely be paying a lot more for the course itself than what you would be saving in your auto insurance premium. 3. Suggestions of moving into a smaller town. This one is just plain silly! While technically this would be true because people who live in smaller towns typically pay less for auto insurance than people who live in big cities, it's still ridiculous to believe that's a consideration in saving money for auto insurance! Sure, you may move to a smaller town because real estate prices are cheaper. But no one ever moves to smaller town just for the purpose of lowering monthly bills. That's ridiculous! But yet you'll see that come up a lot if you try to research ways of saving money on auto insurance as a senior. 4. Suggestions of lowering your auto insurance coverage. Although you probably do not need to carry comprehensive and collision coverage on an older vehicle, there are other important parts of your policy where you do not want to lower coverage. This is especially true for liability coverage and uninsured motorist coverage don't skimp on those! And if a sales rep or an insurance agent suggest you do so, run for the hills! 5. Staying with the same company for a long time earns a big loyalty discount. It doesn't! Although your current auto insurance company would love for you to believe this, it simply isn't true. Again, loyalty discounts with most auto insurance companies is a mere spit in a bucket. Truth is, you will most likely save more money by shopping around for auto insurance. The fact is, many auto insurance companies love seniors and offer low rates. But you will never know it without shopping around. Real ways to save money (Things that actually work!)

1. Paying your policy in full. You can earn quite a big discount by paying your auto insurance policy in full. In fact, I recently done some research on that and conducted a case study. You can see the results of the study here. The end result of a policy that's paid in full versus a policy spread out in monthly payments amounted to an average of 17.6%. That my friend is quite significant! No one earned less than 9.5% and some people saved nearly 30% just by paying their auto insurance policy in full. 2. Shopping around just like everyone else does. I don't know where the idea comes from that seniors belong in a different category as other drivers. The fact is their age group is really not much different than any other age group. And thus you should shop around for cheaper auto insurance just like everyone else does. In fact, these same ways of saving apply to all drivers. 3. Usage based discounts. More companies are providing usage-based discounts, and the discounts can be very substantial. Some usage based discounts go as high as 30% in savings. A prime example of that would be the Progressive Snapshot program. But many other companies are coming out with similar versions also. They all basically work the same way. It simply boils down to three things:1 If you drive your vehicle less than 15,000 miles a year. Refrain from driving between midnight and 4 AM. And 3. Refrain from hitting your brakes hard as much as possible, you will be a prime candidate for a big discount. 4. Paperless discount. Many auto insurance companies are also offering paperless discounts. All this simply is, is having insurance paperwork sent to your email address instead of via US mail. Any documents that aren't required by law to be mailed out will be sent to your email address instead. Contrary to popular belief, most seniors have their own email address. And that is all it takes to qualify for this discount. And for most companies, the average savings is $5-$10 a month. Summary: Don't believe the hype! The four things listed above are the most significant things you can do to save money on your auto insurance policy. The five things listed at the very top are nothing but fluff and window dressing. Get an Auto Insurance quote with Lyles Insurance Call me for a Quote Related Blog Articles: Video: Auto Insurance & Older Drivers: 7 FAQ's |

Author

Dan Lyles is an Independent Insurance Agent serving Ohio, Indiana, Michigan, Pennsylvania, Virginia and West Virginia.. Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed