|

Where can I buy an out-of-state SR22 auto insurance filing? Buying an auto insurance policy with an SR22 filing attached can sometimes be a real pain in itself! But if you live in one state and need an SR22 auto insurance filing in another state, it becomes even more difficult. While you can find plenty of information out there about in-state SR22 filings, there’s not much information available about out-of-state SR 22 filings. The most frustrating part is that only a small percentage of auto insurance companies will accommodate drivers who need out of state SR22 filings. If you don’t know exactly where to look for such a policy, it can be like finding a needle in a haystack. Fortunately, it’s not a lost cause…. There are companies out there that can take care of your problem… If you currently live in Ohio, Michigan, Indiana, Pennsylvania, Virginia or West Virginia, I can help you personally regardless of which state you need the SR22 in…. If you do not currently live in one of those states, this article will at least arm you with what you need to know and steer you in the right direction. Things aren’t as complicated as they seem to be. It just takes three simple steps: 1. Setting your policy up in the right state 2. Choosing the right liability coverage level and 3. Knowing where to look…… Let’s get started! 1. Setting up your policy in the right state. The state that you need to have the SR22 filing in doesn’t matter…. What matters is the state that you’re currently living in. You need to set up your policy in your state of residence. You need to find an agent in that state, not the state you need the SR22 in. 2. Choosing the right Liability coverage level. This part is a little tricky, but not impossible…. Each state decides what their state minimum level of liability coverage is. SR22’s are based on a state’s minimum liability requirement. You need to look up what the state minimum liability requirement is in both the state you’re currently living in and the state you need the SR22 filing in…. Whichever requirement is higher for both bodily injury and property damage between the two states, that’s the level you need to carry on your policy. An agent can help you with that. Here are the current state minimum requirements in the six states that I represent:

*The first two numbers represent bodily injury liability coverage (in 1000’s). **The third number represents property damage liability (in 1000’s). If you need to look up another state’s requirements, a simple google search will work, or your agent can look it up for you. 3. Where to look for an auto insurance policy with an out of state filing. Your best bet is to find an independent agent online that specializes in SR22 auto insurance (aka high risk or non-standard insurance). They are best equipped to handle that “needle in a haystack” problem. The companies that they carry are some of the few who will help you. And they will more than likely carry enough companies to find you an affordable rate. Looking just about anywhere else probable is a lost cause. Less than half of auto insurance companies won’t handle in-state SR22’s, let alone out-of-state SR22’s, which narrows the choices down to a small slice of companies. An SR22 auto insurance agent is the most likely to be able to help you. Shopping online for an agent is the best way as far as efficiency. Just make sure you’re quoting with an actual agent and not directly to a company (quoting one company at a time for your needs would take forever!). Also, make sure you are quoting online with an actual agent/agency vs. quoting with a generic auto insurance quoting site (a real agent/agency will have real names, addresses and phone numbers displayed on their site vs. the fake sites that are anonymous). What if I need an out of state SR22 filing, but I don’t own a vehicle? You simply need a Named Operator’s policy. Everything I’ve said here about regular auto insurance also applies to a named operator policy for those who don’t own a vehicle, but still need an SR22 to get their license back. Summary: There’s no getting around it. Looking for an out-of-state SR22 filing can be a real pain! Follow the steps above and it will make your problems much easier to solve. For those of you who live in Ohio, Michigan, Indiana, Pennsylvania, Virginia or West Virginia, I would be more than happy to help you personally. Simply click one of the quote forms below. Get an out-of-state SR22 Quote with Lyles Insurance here if you own a vehicle Get an out-of-state SR22 Quote with Lyles Insurance here if you Do Not own a vehicle Call me for a Quote Related Blog Articles: Video: Out of State SR22 Auto Insurance Filings Video: How SR22 State Filings work with Auto Insurance

0 Comments

Going online to buy Michigan snowmobile insurance is pretty easy to do. The problem is that snowmobile insurance is similar to snowflakes, in that no two policies are alike. Snowmobile insurance policies are not standardized the way other types of insurance (such as auto insurance) are. As a result, there are some very good Snowmobile Insurance policies and there are some lousy ones! This article will help you better understand the differences between a good and bad policy. You’ll also learn where to shop and where not to shop online for Snowmobile Insurance coverage. Looking in the right places makes it much easier for you to find the lowest rate for the coverage you need. Here are the key things you need to know about buying Snowmobile Insurance online: Exclusive standalone policies vs. policies attached to a homeowners policy. While there are some exceptions, an exclusive standalone snowmobile Insurance policy is usually much better than snowmobile insurance that is attached to a homeowners policy. An exclusive snowmobile Insurance policy tends to have less restrictions, more coverage options, and higher coverage limits than what an attached snowmobile insurance policy does. So if you already have snowmobile coverage attached to your homeowners policy, you might want to look it over closely, and see how it compares to all that is mentioned below. You might be very surprised by the lack of coverage you have. What’s more aggravating is that there is usually little to no difference in premium between an exclusive and an attached policy. Avoid policies that have unreasonable coverage restrictions. This is where those lousy policies that I mentioned earlier come in…. While no personal snowmobile policy will cover you racing, renting your snowmobile to others, or using the snowmobile for business/commercial purposes, all other uses should be covered. But some lousy policies go beyond and place restrictions that are silly. Examples include not being covered off of your property, not covering your sled for recreational purposes (seriously?), or not covering your sled in another area outside of your zip code…. There are not many companies with terms that asinine, but there are a few…. So stay clear of those! Avoid policies that don’t offer any type of medical coverage. A good snowmobile insurance policy should offer both Medical coverage and Uninsured Motorist Bodily Injury coverage. But many snowmobile insurance policies offer neither. Sled accidents don’t happen often, but when they do, serious injuries often happen. I know Michigan residents get hammered with the medical coverage required for auto insurance. But the cost for medical coverage on a snowmobile is much more reasonable and affordable. The same goes for Uninsured Motorist Bodily Injury coverage too. Optional coverages that a good snowmobile insurance policy should offer:

While not all of these add-ons will apply or be important to you, they are important to many sledders that don’t know such coverage exists. And for those who could use any of these above coverages, you'll be surprised to learn how little extra it costs. Always inquire about higher levels of coverage.

Once you’ve zoomed in on a snowmobile insurance policy that you’re about ready to buy, be sure to inquire about higher levels of coverage beforehand. You will sometimes find some great low hanging fruit! Don’t make the mistake of getting into the auto insurance mind set when considering levels of coverage. Snowmobile insurance is priced much cheaper than auto insurance (as is any other type of off-road vehicle)… It never hurts to ask “How much more would it cost for the next higher level of ______?”. That blank can be one of several things, depending on which coverages are more important to you. But they include:

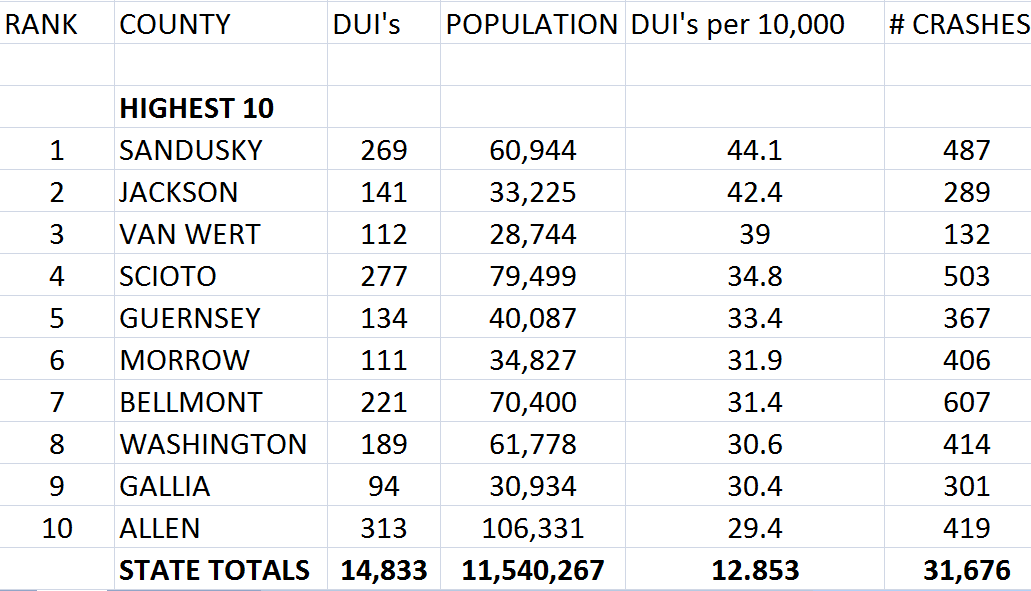

The above are the five basic coverages of a snowmobile insurance policy. I would almost bet that you will find at least one of those five components will only cost you peanuts to upgrade to the next better level. * Quick note about medical payments/benefits coverage: While Michigan law requires auto insurance policies to have unlimited lifetime medical benefits coverage, that does not apply to snowmobile insurance policies. Medical coverage on snowmobile insurance is optional (if it’s offered at all). You get to choose your level of coverage, and it costs much less. Don’t be afraid to look into it. Best place to shop online for snowmobile insurance coverage. Your best bet is to find an independent agent that sells snowmobile insurance. That way, you can get prices from multiple companies at once. This way is more time efficient than having to quote one company at a time. The companies that an independent agent carries tend to be most of the better companies as far as coverage and price for snowmobiles. Summary: As long as you’re making sure you’re following four steps, you can’t go wrong buying snowmobile insurance online: 1. Making sure you do not have a lousy policy. 2. Make sure you're being offered additional coverages that are important to you. 3. Shopping online at the right places (not shopping one company at a time). 4. Inquiring on higher levels of coverage before closing the buy. Happy Sledding! Be safe! Get a Snowmobile Insurance Quote with Lyles Insurance Call me for a Quote Related Blog Articles: Video: Things You Must Know When Buying Snowmobile Insurance in Michigan Video: Basics of a Snowmobile Insurance Policy  A high percentage of drivers in the Portsmouth Ohio area are required to carry an SR22 filing attached onto their auto insurance policy. Getting an SR22 is usually the last step a driver needs to take before getting a suspended driver's license reinstated. Keeping an SR22 filing active is also what keeps a license active during the time that drivers are required to carry an SR22 filing. However, I’ve noticed that many drivers attach their SR22 to the wrong type of policy. This article will help you understand what you need to know as far as setting up the right type of policy, how to look for the lowest rate, and also answer some frequently asked questions. If it seems like the Portsmouth Ohio area and Scioto County in general has an unusually high rate of driver’s who need an SR22 filing, you may have a point.

Confusion about SR22’s Before we begin with how to properly set up an SR22 filing, let me help clear up some confusion about SR22 filings. The terminology many people use causes confusion:

What does an SR22 filing do? The best way to understand what an SR22 filing does is to think of it as a “Tattle-tale”. It lets the state BMV know that you have taken out some type of auto insurance liability coverage with at least state minimum limits of liability coverage. This is what triggers your license to be reinstated (assuming you have also met all other reinstatement requirements)….. However, if you ever cancel or lapse on a policy with an SR22 attached, the auto insurance company is required by law to “tattle” on you to the BMV. The BMV will then suspend your license again until you either reinstate your policy, or start another policy with an SR22 attached. Setting up your SR22 filing the right way. This is very important! I’ve seen a lot of people screw up on this step, and set up their policy the wrong way. However, setting up your policy the correct way is actually very easy to do just by keeping things simple:

That’s all there is to it! As long as you follow this, you know that you have set your policy up properly. Vehicle owners will still have to make important choices regarding the levels of coverage they carry on their regular auto insurance policy. But at least this important first step will have your policy structured the right way. FAQ’s My neighbor has to carry an SR22 filing and he owns a vehicle…. He only carries a Financial Responsibility Bond for both his SR22 filing requirement and coverage for his vehicle, instead of having a regular auto insurance policy….. Is this ok to do? As far as driving legally, yes, it is OK to do. But it is something that I would strongly discourage! A financial responsibility bond is very lousy coverage for a vehicle owner to carry. I know a lot of drivers that do it this way because it is significantly cheaper than having regular auto insurance. But there’s a valid reason why it’s cheaper. The coverage is inadequate for a vehicle owner:

Is it ok to have two separate policies, a regular auto insurance policy to insure my vehicle(s), and a Financial Responsibility Bond to satisfy my SR22 filing requirement? Yes, this is fine to do. And it’s a good idea for a small percentage of people to do so…. But for the vast majority of you, it is usually less expensive to have everything on one regular auto insurance policy. However, it sometimes make good sense to have separate policies if you are a homeowner, have good to excellent credit, and have your auto insurance bundled with your homeowners policy. How long do I need to carry an SR22 filing? For most of you, the requirement period is usually three years. But it can be more or less, especially if it was a court ordered SR22 filing…. To know exactly when your SR22 requirement period expires, you can look that info up for free on the Ohio BMV website (pull up your “unofficial driver abstract”). It’s important that you keep that expiration date in mind. If you detach your SR22 filing too early, your license will be suspended… If you detach your SR22 filing too late, you could be paying extra for needless filing fees. Where’s the best place to look for SR22 insurance? This part can be a bit frustrating because many auto insurance companies won’t write SR22 filings…. Other auto insurance companies will write SR22 attachments, but charge a fortune for it….. Your best bet is with an independent agent who specializes in high risk auto insurance. The companies that they carry tend to be the companies that are more SR22 friendly. One quote with an independent agent can get you quotes from several companies at once. Get an SR22 Quote with Lyles Insurance here if you own a vehicle Get an SR22 FR Bond quote with Lyles Insurance here if you do not own a vehicle. Call me for a Quote Related Blog Articles: Video: How SR22 State Filings work with Auto Insurance Video: Finding Affordable Auto Insurance with a DUI Recent changes to the Ohio BMV's Auto Insurance Random Selection Letter Program |

Author

Dan Lyles is an Independent Insurance Agent serving Ohio, Indiana, Michigan, Pennsylvania, Virginia and West Virginia.. Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed