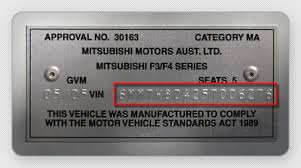

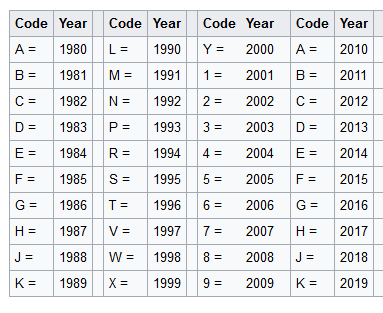

Nothing can be more frustrating than being stuck from getting auto insurance coverage because of a VIN number mismatch. While it doesn’t happen often, as an auto insurance agent, I’ve seen it happen enough. This article might be able to help you resolve those issues, depending on where the problem stems from. It only takes one digit being off to trigger a mismatch. The good news is that going through the “5 Best things to do first suggestions” will solve most of the issues. Also, you’d be surprised to learn how much a Vin number can tell you about a certain vehicle. The bad news is that this won’t help everyone (this is especially true of vehicle models older than 1981, the year American Vin numbers were first standardized). But this will help the majority of you, and you’ll probably learn some interesting things along the way. You will learn the anatomy of a Vin number. But of course, we should begin with the list of “5 Best things to do first” suggestions, as they correct most of the problems. 5 Best things to do first suggestions: 1. Double check the Vin # on paper. The most accurate place to look is on the title itself. Or if your vehicle is financed, check the Vin number on your loan contract. If that isn’t handy, check your state vehicle registration papers. 2. Double check the Vin # on the vehicle itself. The two most common places to look on any vehicle are the corner of the driver’s side dash right under the windshield, and also a sticker placed inside the driver’s side door. 3.The letters “I”, “O” and “Q” are never on Vin numbers. This sounds simple enough, but the I,O and Q errors come up frequently. If you see the letter “I” as in Indiana, it’s probably the number “1”. The letter “O” is probably a zero. *** Note: The only exception to this I-O-Q rule is with state assigned VIN#’s. For example, most state assigned VIN#’s in Michigan start with the letters “MI”. But this mostly applies to special types of vehicles (such as kit cars, assembled vehicles, and off-road vehicles). This won’t apply to 99.9% of you. 4. The 10th Digit is the most common error and very easy to double-check. The 10th digit corresponds to the year of the vehicle, which is very easy to look up. See table below… Does the letter or number match the correct year? *** Note! Also make 100% sure that you have the vehicle’s year correct. I have seen several instances where the Vin # was in fact accurate, but the owner gave the incorrect year of the vehicle to their auto insurance agent. For example, an owner may think his/her vehicle is a 2015 model when in fact it’s a 2014 model. This will flag most VIN verification systems and come back as “10th digit mismatch”…… Check your title or loan contract and make sure that you have the model year correct.

5. Check for visual and verbal errors made when writing or speaking.

Just by checking closely on these 5 things above, the vast majority of errors will be figured out. If you still haven’t solved the problem, don’t give up. Your vehicle’s manufacturer can help you with other digits to help pinpoint the problem digit. It’s just takes a bit of research, most of which can be easily searched online…. Learning the anatomy of a Vin number might help you in that regard….. Anatomy of a VIN number

Summary: There is no sure-fire way to solve all VIN# mismatch problems, because there’s no way of knowing where the error derives….. But this article will go a long way in helping you figure it out. I hope I have helped you… or at least, you learned something interesting. Get an Auto Insurance Quote with Lyles Insurance Call me for a Quote Related Blog Articles: Video: Guide for correcting invalid VIN numbers Video: Why Anonymous Online Auto Insurance Quotes are Useless Video: 8 Common Auto Insurance Advertising Pitches and What They Don't Tell You Why getting an Anonymous Online Auto Insurance Quote is a waste of time

15 Comments

If you’re getting close to having your suspended Ohio driver’s license reinstated, getting an SR22 filing is one of the last steps you will have to take. The easiest and best way to get an SR22 filing is to shop online. But there is a right way and a wrong way to do it. This article will help you understand the two biggest issues you will face, and how to avoid the pitfalls along the way. Those two issues are setting up the right type of policy and shopping in the right places. This article will focus on both of those. But first, we need to clear up some confusion about the term “SR22 Bond”. While the term is very commonly well known and used often, it is actually an incorrect term. There’s really no such thing as an SR22 bond. Ok …. So then what is an SR22, if it’s not a Bond?

What is a Bond?

Buying the right type of policy to set up your SR22. While there is a lot of confusion about how to set up an SR22 filing, it’s actually very simple: If you own a vehicle, you should attach your SR22 filing onto a regular auto insurance policy. If you do not own a vehicle, you should attach your SR22 filing onto a Financial Responsibility Bond (FRB). Attaching the SR22 Filing. Attaching the SR22 is very easy to do. Simply ask your agent to file your SR22, and the auto insurance company will send the SR22 electronically. The SR22 gets sent to the BMV within minutes or hours, depending on the company. The BMV usually takes one business day to process the SR22 before your license becomes active. A faster option is to take your SR22 paperwork to the BMV in person. Then your license becomes active right away. Your agent can print out your needed paperwork SR22 once you buy it, and have it emailed or faxed to you right away…. However, most people prefer to pass on this option because of long lines at their local BMV…. But that option is available if you want. How long do I need to carry an SR22 filing? For most drivers, you will need to carry an SR22 for three years (but not always). To know exactly how long you need to carry an SR22 filing, you can look this up real quick on the Ohio BMV website for free. Click on the “unofficial driver abstract” link (you can also choose the “official driver abstract” link, but they will charge you $5 to do so). Is it ok to carry two separate policies, having a regular auto insurance policy for my vehicle(s) and a Financial Responsibility Bond to satisfy my SR22 filing? Yes. This is fine to do. However, for about 90% of you, this is the more expensive way to do it as opposed to having everything on one policy. But for a small percentage of you, this is a good idea and does make sense. If you own your home, have good to excellent credit, and have your auto insurance bundled with your homeowners insurance, it is likely that having two separate policies is a good idea. I own a vehicle and need an SR22… Can I legally get away with just carrying a Financial Responsibility Bond instead of buying a regular auto insurance policy? Yes, you can legally drive your own vehicle with just an FRB. But that is something I DO NOT RECOMMEND! I know a lot of people do this because of the cheaper price. But there is a big reason for the cheaper price, as it is very lousy coverage for a vehicle owner to have:

Best place to look online for an Ohio SR22 Bond or Auto Insurance policy. This is where it can get tricky and confusing. Many auto insurance companies will not handle SR22 filings. And there are some auto insurance companies who will file the SR22, but they will charge a fortune to do so. Your best bet is to find an independent agent who specializes in high risk auto insurance (AKA non-standard auto insurance). They have at least several auto insurance companies who are more SR22 friendly than standard auto insurance companies. You only need to give your quote information once, and the agent will do the grunt work of shopping around for you. Also, when shopping online for an SR22 attached policy, here are three areas you should avoid: 1. Quoting with captive insurance agents (agents who sell for only one company. I have nothing against captive agents. Most all of them are great agents. But the auto insurance company that they work for are mostly NOT SR22 friendly companies. Almost all SR22 friendly companies go through independent agents. 2. Quoting with one company at a time. Although there is nothing wrong with doing this, it wastes a lot of your time. It can take a half an hour just o quote with two or three companies. It’s very hard to find the best price this way. A lot of people make this mistake because companies tend to dominate search engine rankings over individual agents. 3. Beware of lead generation sites! These are websites that mimic the website appearance as if they are auto insurance agents, but they don’t sell insurance at all. They simply take your quote information and sell it to agents (known as “leads”). This will blow your phone up! The good news is that there’s an easy way to spot these sites. A legit agent or agency will have their name, address and phone number prominently displayed on their site. A lead generation site is more anonymous. If you don’t see a real human being listed as an agent, RUN! Summary: Don’t be overwhelmed or intimidated by shopping online for an Ohio SR22 auto insurance filing. By following the advice given above and avoiding the pitfalls mentioned, you’ve got this! If you have any questions, feel free to call me at 740-574-2618, or drop me an email at [email protected], and I will be happy to answer any questions you have. Also, feel free to get an online quote below. Get an SR22 quote for a Regular Auto Insurance Policy with Lyles Insurance Get an SR22 Quote for a Financial Responsibility Bond with Lyles Insurance Call me for a Quote Related Blog Articles: Video: When does my Ohio SR22 Requirement End? Video: Basics of an Ohio Financial Responsibility Bond Video: Ohio SR22 Bond FAQ's How much does SR22 bond insurance cost in Ohio? How long will it take for my License to be Reinstated after I buy an Ohio SR22 Bond? Buying mobile home insurance in Ohio is very easy to do. However, you must understand the coverages before you can buy a policy. Going in blindly without knowing coverages, and just buying any mobile home policy could lead to major headaches in the future. This article will help you understand the basics of an Ohio mobile home insurance policy, so that you know how to pick the right type of coverage for your needs. If you are familiar with homeowners insurance, mobile home insurance is very similar in some ways but different in others. So to better help you understand mobile home insurance and how the coverage works, let's start off with the six basic coverages that any good mobile home policy should have: 1. Dwelling Coverage. This is your main coverage. This is what insures the mobile home itself and any other structures permanently attached to your mobile home. If your home is damaged or destroyed, dwelling coverage will be the coverage that repairs or replaces it. You want to make sure that you have plenty of coverage here. If your mobile home gets destroyed in a fire, you would need coverage that will completely replace your mobile home. Many mobile home owners aren't carrying enough coverage. Also, the coverage level you choose for your dwelling also affects the coverage levels of other major components listed below, as some are based on a percentage of the coverage levels you have for dwelling coverage. 2. Other Structures Coverage. This covers any other structures on your property that is not permanently attached to your mobile home. This could include things such as a hot tub, gazebo, tool shed, etc. 3. Personal Property coverage. Personal property coverage is another major component in which you want to be damn sure that you have enough coverage to replace all of your personal property. This includes just about everything as far as contents is concerned: furniture, clothing, kitchen ware, electronics and tools just to name a few. You get the idea! If your mobile home gets destroyed, replacing your personal property can cost a fortune! 4. Liability coverage. Liability coverage is very important in case a visitor gets seriously injured on your property. Let’s suppose someone falls on your property, breaks their neck, and decides to sue you. This is where liability coverage comes into play. A good mobile Home Insurance policy will offer up to $100,000 in coverage. *** Note: Pools, trampolines and dangerous pets… Mobile Home Insurance companies vary greatly so if you have any of the above you need to take a good look at your policy to see if there’s any exclusions or limitations. Many companies will either limit liability coverage or exclude liability coverage completely for pools, trampolines and dangerous pets. 5. Medical payments to others coverage. This coverage is very similar to liability coverage, in that it covers you for people who get injured on your property. The difference between the two is that medical payments to others coverage is intended to cover minor injuries. Most mobile Home Insurance companies will offer up to a $1000 or $2000 limit. 6. Damage to personal property of others coverage. This covers you for damage if you or someone in your household damages other people’s property. The amount of coverage offered varies from one company to the next. But it is usually only offered in low amounts. Other aspects of Ohio Mobile Home Insurance that you need to be aware of: What types of mobile homes are acceptable? Besides a regular mobile home, you can also insure a manufactured home, modular home and 5th wheel campers and travel trailers. (5th wheel campers and travel trailers must have permanently attached fixtures to it, and can only be used as a seasonal residence). 5th wheel campers and travel trailers: Mobile Home Insurance or Motor Home (RV) Insurance? There is some confusion about whether fifth wheel campers and travel trailers should be insured under a Mobile Home Insurance policy or a Motor Home Insurance policy? The answer depends on its signs of permanency. The basic rule of thumb is: if your fifth wheel camper or travel trailer can be moved within 30 minutes without professional help, it should be insured under a motor home policy. If it takes longer to move your home than 30 minutes, or requires professional help to be moved, then it should be insured under a mobile home policy. Replacement cost coverage versus actual cash value coverage. For those of you with mobile homes 10 years or newer, your mobile home qualifies for Replacement cost coverage. If you qualify for replacement cost coverage for your mobile home, I highly suggest you take that coverage versus Actual cash value coverage. Replacement cost coverage doesn't factor in market value or depreciation like actual cash value does. The difference is price is minimal, but the difference is coverage is huge! Always go with replacement cost coverage if it's available to you. I've had prior claims on a mobile home before. Can I still find coverage? In most cases, yes, but it depends on what those claims were and what the dollar amounts paid out were. Some companies will allow you to be insured with as many as five claims. Some companies are more lenient than others. So if you have had any claims in the past, you may need to shop around a little more. But finding coverage at an affordable rate is still doable even with prior claims. Summary: You have many companies to choose from buying mobile Home Insurance. However the levels of coverage you carry are critically important. You’d be very surprised to learn that there’s very little difference in price between a good Mobile Home Insurance policy and a lousy one. Get a Mobile Home Insurance Quote with Lyles Insurance Call me for a Quote Related Blog Articles: Video: Basics of a Mobile Home Insurance Policy If you need an FR44 auto insurance filing to reinstate your driver’s license, there are things that you need to know and proper steps that you need to take. This article will guide you through the process and explain everything you need to know to make the process as painless as possible. To make sure we’re all on the same page, let me start off with some basic FAQ’s regarding FR44 auto insurance. What is an FR44?

Who is required to carry an FR44 filing? The FR 44 was created to primarily apply to drivers who have been caught for DUI. However that’s been expanded over the years. For a complete list of who is required to carry an FR 44, below is copied verbatim from the Virginia DMV’s website: FR-44 certification is required for the following convictions:

What’s the difference between an FR44 filing and an SR22 filing?

The only difference is that FR44 liability insurance coverage limits are double the SR22 insurance coverage limits:

How can I get an FR44 filing if I do not own a vehicle? No problem! You simply need to take out what’s known as a Named Operator’s policy (a.k.a. non-owners policy). As long as your policy is covered for the amount of liability coverage you need, you can attach either an FR44 or an SR22 filing to a named operator’s policy, just the same as you do a regular auto insurance policy. *** Warning about canceling an FR44 attached policy!!!! As I mentioned earlier, if you cancel a policy while you’re still required to carry the FR44 filing (or the SR22), your license will be suspended again unless you replace it with another active FR44 attached policy right away. In most states, making your license active again simply involves putting another FR44 in force, or reinstating the old policy. However, in Virginia, you have a very short window to do so with about being charged with another $145 license reinstatement fee. How short of a window? That’s a great question! Nothing is mentioned about it on the Virginia DMV website…. I personally called the DMV and asked this question a few days ago…. I didn’t get a straight answer. “About four or five days” was their response. I have no clue how to advise you given such a lousy “official” response. Which is it? Four days or five? …… Personally, I wouldn’t want to chance it any number of days. How do I set up an FR44 filing? This is very simple:

Not all auto insurance companies offer FR44 filings and many don’t write named operator policies either. So you’ll have to do some looking around to find the right company for your needs (see below). Where is the best place to find an affordable FR44 attached auto insurance policy? Your best bet is to contact an independent insurance agent that specializes in high risk auto insurance. They will have multiple companies that go easy on drivers with a bad driving record and those who need state filings. Getting a quote this way, you only have to give your quote information once, and the agent will do the dirty work of shopping around for you. Where not to look for an FR 44 auto insurance quote: Quoting directly with an auto insurance company. While there’s nothing wrong with doing this, it is very inefficient as far as finding the lowest possible price to fit your needs. It could take you nearly half a day to get enough quotes from multiple companies to do the same thing an independent agent can do for you in a matter of a 5 minute online quote or phone call. But many people fall into this trap because big auto insurance companies tend to dominate search engine rankings. Quoting with a captive insurance agent (agent who only works for and sells for one insurance company). There’s nothing wrong with captive agents. The vast majority of them are great people and great agents. The problem is that the companies they represent are usually the companies that don’t want your business. Every company has their own appetite as far as which customers they want and don’t want. They price premiums accordingly. Many of them won’t even write FR44 or SR22 filings…. The companies that are more FR44 friendly tend to channel towards independent agents. Quoting with a lead generation site. Beware of these websites! They are very deceptive. They design their website so that it looks like an insurance agent’s website. The problem is, they don’t sell insurance at all! They simply pretend to be agencies and collect your quoting information. Once they have your quoting information, they sell your information to other insurance agents…. In many cases, they will sell your info to dozens of agents…. This will cause your phone to blow up! There is an easy way to tell a real agent’s site from these fakes. Simply look for a name, address and phone number. A real agent will list all of that info prominently on their site to where it’s a real person you’re dealing with. If all you see posted is maybe a 1-800 number without an actual agent/agency name and location, RUN! Summary: Without knowing the info above and also knowing where to look for the best priced policy that fits your needs, the whole FR44 filing process can be a real pain in the ass! But by following the info I’ve given above, you will now know how to find the right coverage you need at an affordable price. Simply fill out one of the two quote forms below, and I will be happy to guide you through everything, and have you taken care of. Get an FR44 Quote here with Lyles Insurance if you own a Vehicle Get an FR44 Quote here with Lyles Insurance if you do NOT own a Vehicle. Call me for a Quote Related Blog Articles: What is a Virginia FR44 Auto Insurance Filing? Video: Buyers Guide: Virginia FR44 Insurance Video: Virginia FR44 Named Operator Auto Insurance Video: What is Virginia FR44 Auto Insurance Video: Understanding Virginia FR44 Auto Insurance Filings Where can I find the cheapest Virginia FR44 Auto Insurance Filing with a DUI on my record? |

Author

Dan Lyles is an Independent Insurance Agent serving Ohio, Indiana, Michigan, Pennsylvania, Virginia and West Virginia.. Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed