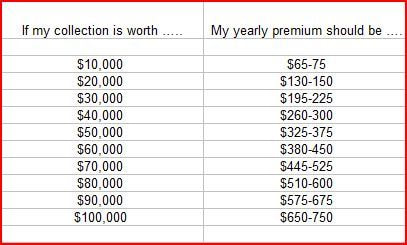

American Collectors Insurance: Insurance for Collectibles That Does Not Require an Appraisal8/29/2012 If you own something collectible that is worth significant value, finding the right insurance coverage that covers your item(s) adequately can be difficult. Insuring collectibles under your homeowners policy is very limited. Finding stand alone coverage just for your collectibles can be difficult due to all the hoops you normally have to jump through. Most insurance companies require an appraisal to insure collectibles of any significant value. However, American Collectors Insurance DOES NOT require an appraisal. American Collectors Insurance offers no non-sense, agreed value coverage on most all types of collectibles. Unlike the underwriters involved in a homeowners policy, who have little to no experience in collectibles, underwriters at American Collectors Insurance specialize in collectibles and have a much better understanding of value in the case of a loss. Here are some of the collectibles American Collectors will insure: Cost of collectibles insurance While costs will vary depending on what type of collectible, most collectibles fall in about the same price range: If you live in Ohio, Michigan, Indiana, Pennsylvania, Virginia or West Virginia, you can get an online collectibles quote with my agency by clicking below. Get a Collectibles Insurance Quote with Lyles Insurance Call me for a Quote Related Blog Articles: Video: Tips for Buying Insurance on Sports Memorabilia Video: Buyers Guide for Insurance on Figurines & Action Figures Video: Right Way and Wrong Way to Insure your Collectibles

0 Comments

Auto insurance companies have become very selective as to which drivers they prefer to insure and which drivers they would rather not insure. These drivers are often referred to as "high risk" drivers. If you have some dings on your driving record, you might become frustrated trying to find affordable auto insurance. Fear not! It might be challenging, but while some companies may shun high risk drivers, other companies welcome them. Finding a good rate is simply a matter of quoting with the right companies. What do insurance companies consider a "high risk" driver? That answer varies from company to company. Some companies are more risk tolerant than others. But generally, these are some of the things that will land you on a high risk radar:

The best way is to get quotes from independent agents that have multiple companies to quote you with. The more companies the agent has, the better your chances at getting the best rate. Agents who only sell for one company (known as "captive agents") can only offer you one quote, and most of those companies shy away from the high risk market anyways. If you live in Ohio, Michigan, Indiana, Pennsylvania, Virginia or West Virginia, you can get an auto insurance quote with my agency. Depending on which state and what your needs are, I have 6 companies that go soft on drivers with bad records: Progressive, GMAC, Kemper Specialty, Dairyland, Omni and PSI. Get an Auto Insurance Quote with Lyles Insurance Call me for a Quote Related Blog Articles: Out of State SR22 Auto Insurance Filing: Living in one state and needing an SR22 filing in another Employment Practices Liability Insurance (EPLI) covers an employer and its employees against claims made by current, former or potential employees for actual or alleged claims involving the following:

EPLI is not new. It's been around over two decades. EPLI started as an add-on endorsement option on a Business Owner's Policy. But over time, these type of lawsuits have become more common to the point where broader and more complete coverages were needed. This is how EPLI evolved from being an add on to becoming a stand alone policy of its own. Purchasing stand alone EPLI insurance provides coverage options that are not usually offered with EPLI as an attachment to a Business Owner's policy:

If your business is located in Ohio, Michigan, Pennsylvania, Indiana, Virginia or West Virginia, you can get a fast EPLI quote with my agency to see how stand alone EPLI rates compare. These policies can be tailored to the smallest business with just a couple of employees to a large business with up to 250 employees. I handle all quotes personally and privately. Get an EPLI Quote with Lyles Insurance Call me for a Quote |

Author

Dan Lyles is an Independent Insurance Agent serving Ohio, Indiana, Michigan, Pennsylvania, Virginia and West Virginia.. Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed