|

If you are carrying an Ohio SR22 financial responsibility bond, you may be a bit surprised to see your rate go up upon renewal. That is because the new state minimum law went into effect December 22, 2013. Any bond or regular auto insurance that only carried the old state minimum limits must be increased if the policy renewed on or after that date.

However, with most of the changes I've seen the increase in premium have only been very minimal. By minimal, I mean usually 10% or less. If your SR 22 bond increased by any more than that, then it may be time to shop around for a cheaper rate. Because there are plenty of companies who are only increasing the rate by pennies on the dollar. Is this minimum coverage increase a one time thing, or will it continue to increase in the future? That is a great question. Obviously, I don't know the answer to that. That is up to Ohio lawmakers. But if the past is any indication of the future, you will probably not have to worry about another increase for a long time. I'm 41 years old. And when these old state minimum levels were set, I wasn't born yet. So this is the first increase that's happened in my lifetime. How much does liability coverage increase with the new state minimum limits? The new state minimum limits are double what the old limits were in terms of bodily injury. And they are more than triple the old coverage in terms of property damage. Old Minimum: 12.5/25/7.5 New Minimum: 25/50/25 What the numbers mean: 25/50, the first two numbers represent the maximum your liability coverage would pay in thousands if you were at-fault in an accident and injured someone or multiple people. The first number ($25,000) is the most any one person could collect from their injuries. The second number ($50,000) is the most that it would pay in total for multiple injuries. The third number ($25,000) represents the total your liability coverage would pay for property damage. Am I to assume that this new coverage minimum level is adequate? No! Keep in mind that Ohio had one of the lowest levels of state minimum coverage in the country. This increase simply upgraded Ohio from the category of very lousy to just lousy. The reason is because it will only protect you for minor accidents. It will not sufficiently cover you if you're at fault in a serious accident. It only takes a couple days in the hospital to exceed $25,000. So, for those of you who have financial responsibility bond, which are only offered at state minimum liability levels, you might want to change the type of policy in order to get higher coverage. The best way to do this if you do not own a vehicle is to get a named operator's policy or a broad formed name driver policy. Not only will this offer you higher levels of liability coverage, but it will also offer you medical payments and uninsured motorist coverage. Both of which are not offered with financial responsibility bonds. And just like regular auto insurance or financial responsibility bonds, both of these types of policies can attach your SR22 filing onto them. Summary: Don't sweat it because the state minimum went up. The increase is only very minimal. And if you've seen an increase more than just minimal, it's either because another changing factor caused your premium to go up, or your company is simply not competitive price wise with the new increase. If it's the latter, then you may need to shopping around for lower rates. Get an SR22 quote with Lyles Insurance here if you own a vehicle. Get an SR22 quote with Lyles Insurance here if you don't own a vehicle Call me for a Quote Related Blog Articles: Video: What is an Ohio SR22 Bond? What you need to know before you buy an Ohio SR22 Bond Online What is an Ohio SR22 Bond?

0 Comments

What is an SR22 bond and how is it different from regular car insurance? An SR22 filing is not really insurance at all. It is a state filing that attaches onto either a regular auto insurance policy or a financial responsibility bond (which is how the incorrect term "SR22 bond" got it's nickname). An SR22 filing is a guarantee to the state BMV that a driver is keeping active auto insurance with at least state minimum liability coverage. Once your drivers license is reinstated, you may be required to carry an SR22 for a certain period of time. What happens if I let the SR22 cancel / lapse? If you required a state filing by the Ohio BMV, then the company is obligated to notify the Ohio BMV that your policy has cancelled. This will result in your license being suspended again, and your license will remain suspended until you reinstate the bond or purchase a new one. What are the state minimum liability minimum limits in Ohio? State minimum will pay up to $12,500 per person for injuries, up to $25,000 total. Also, if the accident causes damage to the other vehicle, it will pay up to $7500 for property damage. If the damages you caused exceed the policy limits, you may be held responsible for the remainder of the damage. **** NOTE: as of Sunday December 22, 2013, the new law goes into effect and these numbers above will increase. The new law requirement will double the bodily injury coverage, and more than triple the property damage coverage. The new coverage requirements will be 25,000/50,000/25,000. Does an SR22 cover a driver on a MOTORCYCLE? NO! Auto insurance coverage of any type does not carry over to a motorcycle. If you already have an active SR22 filing with an auto policy, there's no need to purchase a second SR22 for a motorcycle. You simply need to buy motorcycle insurance by itself to drive legally. If you do not have an SR22 in force and you need it to drive a motorcycle. I have companies that write SR22's just for motorcycles. If you need an SR22 just for a motorcycle, you can get a motorcycle insurance quote here. How long will the Ohio BMV require me to carry a state filing? This answer can vary, especially if it's a court-ordered SR22. But generally, SR22 filings are required for 3 years. To find out when your SR22 expires, you can find out online for free at the Ohio BMV website and ordering a 2 year driver abstract. How long does it take for me to be covered on an SR22 bond? In many cases it only takes minutes to put the policy in force. There are two ways to process it with the Ohio BMV: Easy option: Simply do nothing. Once you buy a policy, the SR22 automatically files electronically to the state BMV. The BMV usually processes the SR22 within one business day. Faster option: I can print your SR22 paperwork right away and email/fax it to you. So you can take the paperwork to a BMV reinstatement location personally, where they will process it for you in person. How do I set my SR22 Filing up as far as auto insurance is concerned? This is the part where people like to make things over complicated. But it's really very simple:

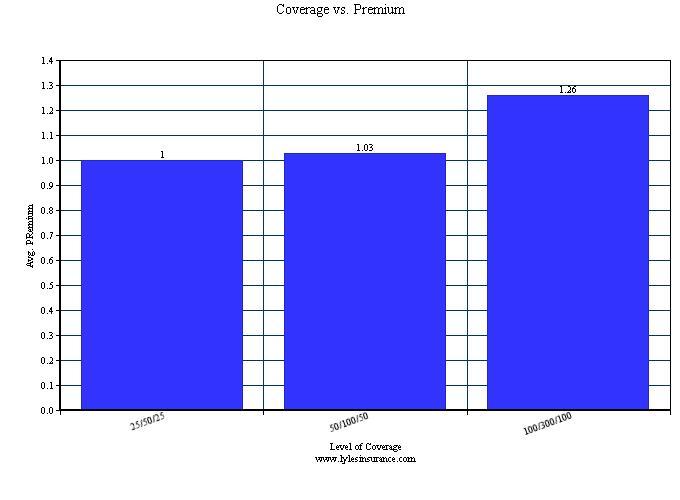

Where's the best place to find the cheapest SR22 rates? Your best bet is to find an independent agent with companies who specialize in SR22's and high risk insurance. That way, you only need to quote with an agent once. An independent agent will do the shopping around for you to find the company with the cheapest rate. If you would like to get a quote with me, simply click on one of the two links below, and I will quote you with the SR22 companies that I carry, and find you the best rate. And as always, I handle all quotes personally and privately. Get an SR22 quote with Lyles Insurance here if you own a vehicle Get an SR22 quote with Lyles Insurance here if you DON'T own a vehicle Call me for a Quote Related Blog Articles: Video: What is an Ohio SR22 Bond? Video: Ohio BMV & SR22 Auto Insurance Reinstatement Guide What is an Ohio SR22 Bond? Ohio SR22 Bond FAQ's In order to save money, many people choose to skimp on their auto insurance liability coverage, and go with the lowest limits that their state will allow. As I have preached to people countless times, this is a very bad idea! But no matter how hard an agent tries to get the point across, not too many listen. So, I decided to do a case study on auto insurance liability coverage to see just how much an increase in coverage raises auto insurance premiums. So for my case study, Here's what I did:

Key Finding: Significantly increasing liability coverage only amounted to pennies on the dollar more in premium.

Notes about the case study:

Summary: When considering low levels of liability coverage, hopefully this case study will make you think twice, and finally sink in. Doubling liability coverage only amounted to about 3 cents on the dollar, and taking even higher levels only amounted to about a quarter on the dollar. As I've mentioned before, state minimum liability coverage (no matter which state you live in) is lousy! These small increases in premium are well worth the higher coverage that you get for it. Also keep in mind that Uninsured Motorist (UM) coverage is very important, and it is limited to the amount of liability coverage you select. So if you go skimpy on liability coverage, you force yourself to go skimpy on UM coverage as well. Get an Auto Insurance quote with Lyles Insurance Call me for a Quote Related Blog Articles: The Basics of an Auto Insurance Policy: Breakdown of each coverage explained  As many of you are aware, Ohio lawmakers passed a bill in December 2012 that raised the state minimum auto insurance liability requirement. Although they have given an entire year's grace period before the change goes into effect, that grace period is ending December 22, 2013. I will explain what this means for the customer in terms of coverage and cost, and how the deadline date applies to your auto insurance policy. Change in coverage: Old Limits: 12.5 / 25 / 7.5 New Limits: 25 / 50 /25 What do the numbers mean?

Example: Let's suppose you are driving and run a red light, and crash into a vehicle with 2 people in it. We'll assume you are carrying the old state minimum of 12.5/25/7.5...... As a result of the accident, both persons are injured and the vehicle you hit (that's worth $5000) was totaled. One person's injuries amounted to $15,000 in medical expenses, the second person's expenses totaled $10,000....... With 12.5/25/7.5 coverage, your policy would pay the first person $12,500, the second person $10,000, and $5000 for damage to the vehicle. How will this increase affect rates if I'm carrying the old state minimum limits? It depends on when your policy expires. If it expires on or before Dec. 21, 2013, you can stay grandfathered into the old state minimum rates for one more policy period. When your policy expires again in 2014, you will then be required to carry the new higher limits upon renewal. If your policy expires/renews on or after Dec. 22, you will be required to carry the new rates right away upon renewal of your policy. How much more will this higher coverage cost? You may be worried that because the bodily injury part is doubling, and the property damage part is more than tripling, that the increase might become unaffordable..... However, you will be surprised to know that the increase will only be minimal in terms of cost. In most cases, the increase will only amount to an increase of roughly 10% (will vary, being higher or lower, depending on the company). So don't sweat it! For most, it will only cost pennies on the dollar more. If your policy increases much more than that solely because of the liability increase, it may be time to shop around with other auto insurance companies. Does this new higher state minimum limit provide adequate coverage? For a minor accident, yes. But for a major accident, definitely NO! This new increase only upgraded the coverage from very lousy to lousy. Even with the new single limits of $25,000, it is very easy to exceed that amount with only a short stay in the hospital. Anything that runs over that amount, you are liable for. That's why it's important to understand that just because the minimum coverage is going up, doesn't mean that it is now adequate. Not even close! However, I realize that many people carry financial responsibility bonds or named operator (aka named driver) policies only as secondary coverage to satisfy an SR22 requirement. And for those who don't need the extra liability coverage because of having another policy in force with higher liability limits, I can understand why you want to stay locked into the old limits as long as you can. What if I buy a new policy this month... Can I stay locked into the old minimum? As long as you buy the policy on or before December 21, you can still stay with the old limits for the length of that policy. But again, unless you are using this only as a secondary policy, this is something I highly discourage for reasons mentioned above. If you would like to get a quote for auto insurance, click on one of the two links below, and I will run your quote with the companies I carry, and find the company with the best rate. And as always, I handle all quotes personally and privately, and do not sell or share your information with anyone. Get an Ohio Auto Insurance Quote with Lyles Insurance here if you own a vehicle Get an Ohio Bond Insurance Quote with Lyles Insurance here if you Do Not own a vehicle Call me for a Quote |

Author

Dan Lyles is an Independent Insurance Agent serving Ohio, Indiana, Michigan, Pennsylvania, Virginia and West Virginia.. Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed