|

Renter’s Insurance is very important coverage to have. It provides very valuable coverage at a low price. But yet about 2 out of every 3 renters go without this coverage. If you took away the rental companies that require renters insurance, the numbers would be even worse. In the Portsmouth Ohio area, personal property theft is at an all time high. Many of these thefts would be covered with renter’s insurance. The Scioto county area in general gets their fair share of severe storms powerful enough to cause major damage…..But yet the majority of tenants pass on renter’s insurance. Why? It’s certainly not the cost. Renter’s insurance is very inexpensive. I believe it’s simply because many people aren’t aware of the value of having renter’s insurance. So let me show you seven scenarios where renter’s insurance can be a huge benefit: 1. Fire scenario. What happens if a fire destroys all of your property? Are you going to be able to replace all of your personal property out of pocket? With renter’s insurance, you can select the level of personal property that you're carrying. This can be as low as $10,000 or as high as $50,000 with most companies. 2. A visitor gets hurt while on your property and suffers a minor injury. With renter’s insurance this would be covered under the medical payments to others coverage. Coverage up to $2000 is available. 3. A visitor gets hurt while at your property and suffers a major injury. This is also covered on a renter’s insurance policy under liability coverage. You can select levels of 25,000, 50,000 or $100,000 in liability coverage. 4. Theft. Unfortunately this is becoming more and more common in the Portsmouth Ohio area. The major drug epidemic that the area is going through is causing a lot more theft cases. Renter’s insurance is a good way to protect your personal property in the event that it is stolen. 5. Being displaced (Loss of Use Coverage).

Imagine a big tree falls on your apartment building and causes severe damage to the roof. You may have to spend some time staying elsewhere while the roof is being repaired. That's why it's very important to have Loss of Use Coverage on your renter’s insurance policy. This would apply to a broad range of risks, including the fire scenario example mentioned earlier. Loss of Use Coverage helps cover your hotel and food expenses should you be forced out of your apartment for a temporary period. 6. Identity Fraud. More people are becoming victims to identity fraud. While many renter’s insurance policies do not cover identity fraud, a good renter’s insurance policy will offer the coverage on an optional add-on basis. If you were to choose this coverage and someone steals your identity, Identity Fraud Coverage will pay up to $2500 in expenses involved with trying to correct the situation. 7. Water Backup/Sump Discharge or Overflow Coverage. This is usually offered as optional add-on coverage. But it will come in very handy if your personal property is destroyed. This covers your property if it is ruined from damage to pressurized plumbing systems. Not all renter’s insurance companies offer this coverage, only the better policies. Other key points you need to be aware of: Replacement cost coverage vs. Actual cash value coverage. There is a huge difference in coverage between the two. Replacement cost coverage pays what it would cost to replace your damaged personal property. A policy covered under an actual cash value basis only pays you for what your personal property would be currently worth prior to the damage. It’s basically the difference between the value of new property and used property. A good renter’s insurance policy will offer the option to replace your property on a replacement cost basis. The difference in cost is very minimal. It’s a no-brainer to select replacement cost coverage over actual cash value coverage. In fact, I would shy away from any rental insurance company that doesn’t offer replacement cost coverage. Keep good inventory of the personal property that you have, and get a good idea of the total value of all your property. In the event there is a total loss to your personal property, it’s hard to remember everything you had in your home. The best way to do this is to take a walk through your home and video record all of your property. Also be sure to store it somewhere in a remote location, whether with a family member or in cyberspace. This way, if there is a disaster, you have a quick reference to list all of your property…. This will also help speed up the claims process as well if something were to happen. If you need help figuring out a total value of your personal property, there are plenty of free web sites out there who will help you with this. This is very important to do because you want to insure your property for the right amount of coverage. Be careful of the very cheap Renter’s Insurance policies! The old saying “you get what you pay for” can be very true with renter’s insurance. Make sure you take a good look at your policy and find out exactly what coverage you have and how much coverage you have insured. Many renter’s insurance policies are very cheap for a reason. The coverage is very stripped down and minimal. Make sure that you have adequate levels of coverage of the things I’ve mentioned above. Especially look to see that you have replacement cost coverage! The difference between a good renter’s insurance policy and a lousy one usually only amounts to $10.00 a month or less. There’s no reason to skimp on coverage for that little of a price. Summary: When you consider the value of what a good renter’s insurance policy brings and compare that with the price, it’s a no-brainer to buy a good renter’s insurance policy. This is especially true in the Portsmouth Ohio area, but true anywhere else as well. But don't cheat yourself by settling for minimal coverage. Renter's insurance coverage becomes critically important when something happens! Get a Renter's Insurance Quote with Lyles Insurance Call me for a Quote

0 Comments

It’s always a great idea to shop around for a cheaper rate on your auto insurance policies. Financial advisers recommend that you do it at least every two years. But what do you do next if you find an auto insurance company that has a lower rate than the one you’re currently paying? It’s very easy to change auto insurance companies from one company to another. But there is a right way and a wrong way to do it. Doing it the wrong way can lead to some big headaches in the future! There are only few key steps here that you need to be aware of, but it’s very important that you know them. Understanding the key steps below will keep things rolling smooth, and prevent you from having big problems later. Be sure you are comparing apples to apples. It is very important for you to compare another auto insurance company’s rates with the same exact coverage (if not better) than what you already have now. If you don’t exactly what coverage you currently have, it’s impossible for another agent to compare apples to apples. Any auto insurance company can beat a rate if the coverage is gutted. Comparing auto insurance rates will do no good if you’re not comparing them with at the same levels of coverage as what you have now:

Things to keep in mind after you have decided to switch auto insurance companies.

Remember that once a cancellation or expiration of a policy occurs, the cancellation or expiration takes effect at 12:01 AM with most companies. Many people get confused by this. Don’t cancel your old policy until you’re 100% sure that your new policy has gone into effect.

For those of you who need an SR22 filing, I recommend at least a one day overlap. License bureaus can take time to process SR22’s. You definitely don’t want any underlap with an SR22 filing, or you license could be suspended.

Before you close the deal on your new auto insurance policy, it’s always a great idea to inquire on how much more a higher level of coverage costs vs. the coverage you’re about to choose. Many of you will be very surprised!

In the end, YOU make the decision to accept or pass on better levels of coverage. But accepting lower levels of coverage without comparing the prices for higher levels is a big mistake! If you’ve only had auto insurance coverage for less than six months:

If at all possible, you’re much better off waiting until you’ve had continuous coverage for at least six months before you shop around with another auto insurance company. WHY? Because once you have had continuous coverage for six months, auto insurance companies will offer you a very significant discount. IF YOU CHANGE AUTO INSURANCE POLICIES BEFORE YOUR OLD POLICY EXPIRES, BE SURE TO CANCEL THE OLD POLICY PROPERLY! I put that in all caps for a reason. A lot of people screw up on this! Leaving an old policy when it expires is ok. But be careful cancelling a policy in the middle of a policy period. Make damn sure you initiate the cancellation! Usually, all it takes is a two minute phone call to your agent. You may need to sign or E-sign a cancellation document, but that’s about as hard as it gets. What you don’t want to do is simply let the old policy lapse for non-payment. Many people make this mistake. Once they pay a down payment on their new policy, they simply forget or ignore the old policy, and let it cancel on its own for non-payment….. This is a terrible mistake! Many auto insurance companies would will not only bill you for this, but many companies also send it to a collections agency and report it on your credit report. This can’t screw up your credit score for a long time! Summary: It’s always a good idea to shop around for a better rate on auto insurance. Just be sure to keep the above things in mind. Doing the little things here goes a long way in making sure you’re not sacrificing better coverage for a lower rate. And if you’re switching companies while currently in the middle of a policy period, be sure follow through with the recommendations above, so that creditors won’t chase after you. Just doing the little things can make all the difference in the world. Get an Auto Insurance Quote with Lyles Insurance Call me for a Quote Related Blog Articles: Video: Auto Insurance & Older Drivers: 7 FAQ's Video: Factors used in Calculating Auto Insurance Rates Video: Do's and Don'ts of buying Auto Insurance Online Video: 13 Deadliest Driving Behaviors Help! A Vin Number mismatch is causing a snag in buying Auto Insurance It’s always a terrible idea to drive drunk or drugged anywhere. This is especially true in the state of Ohio, where the Ohio State Highway Patrol doesn’t mess around with DUI’s! If you drive impaired in Ohio, chances are you will get caught sooner or later. The vast majority of people understands and is very aware of that. However, impaired judgment sometimes leads to impaired decisions. I am not here to lecture, preach or pass judgment on any of you that this has already happened to. Whatever has happened in the past can’t be reversed, so there’s no use dwelling on it. As an independent agent that specializes in SR22 auto insurance, I help a lot of customers with DUI’s on their record get their license back again. And over the years, I have noticed that some areas of Ohio can be a lot busier than others, as far as people with DUI’s needing auto insurance with an SR22. This made me curious…. Are some areas enforced more than others? And also … Can any conclusions be drawn from examining DUI statistics, as far as some areas being targeted more than others? Fortunately, the statistics that might give us an answer are very easy to find because they are posted on the Ohio State Highway Patrol’s (OSP) website. The stats you’re about to see are the DUI charges the OSP has caught drivers with since January 1, 2017. They represent the first half of the year, plus July the 4th week added in (numbers reported as of July 9th). So to get a close idea of yearly projections, take the numbers and double them. Three Things to keep in mind about these stats:

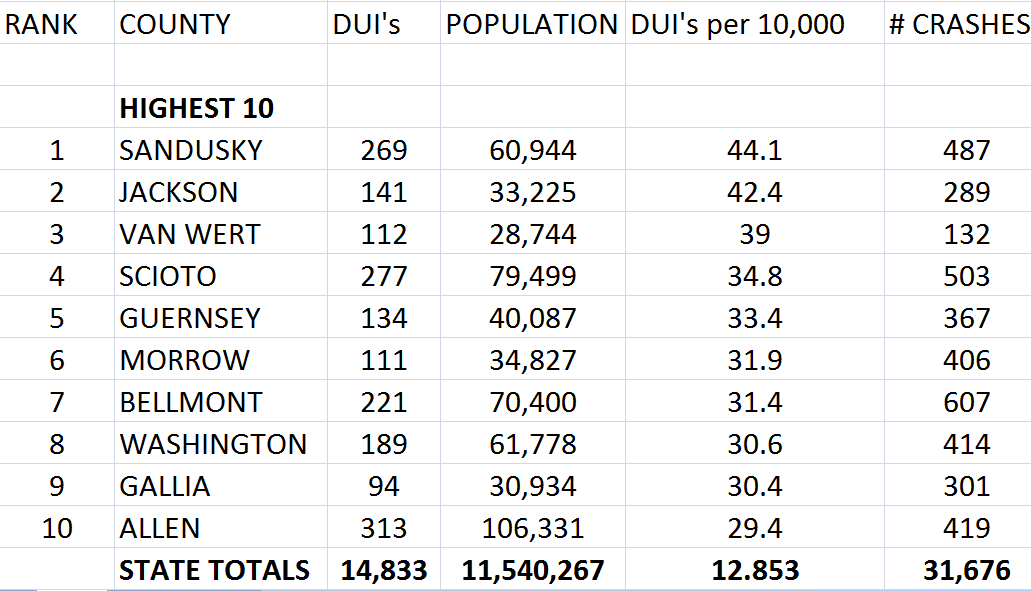

Top 10 Highest Counties for DUI’s per Capita Stats from 1/1/17 - 7/9/17 Similarities:

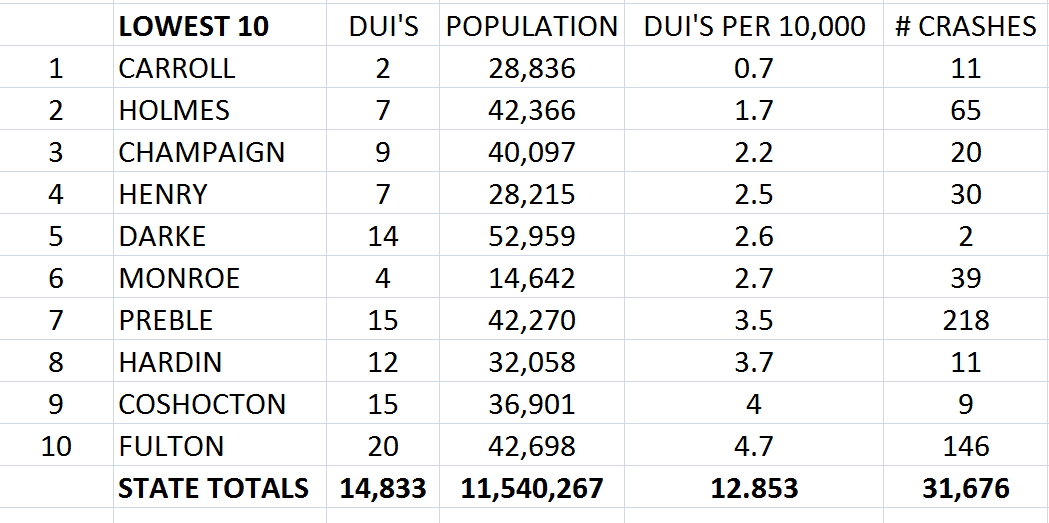

Top 10 Lowest Counties for DUI’s per Capita Similarities:

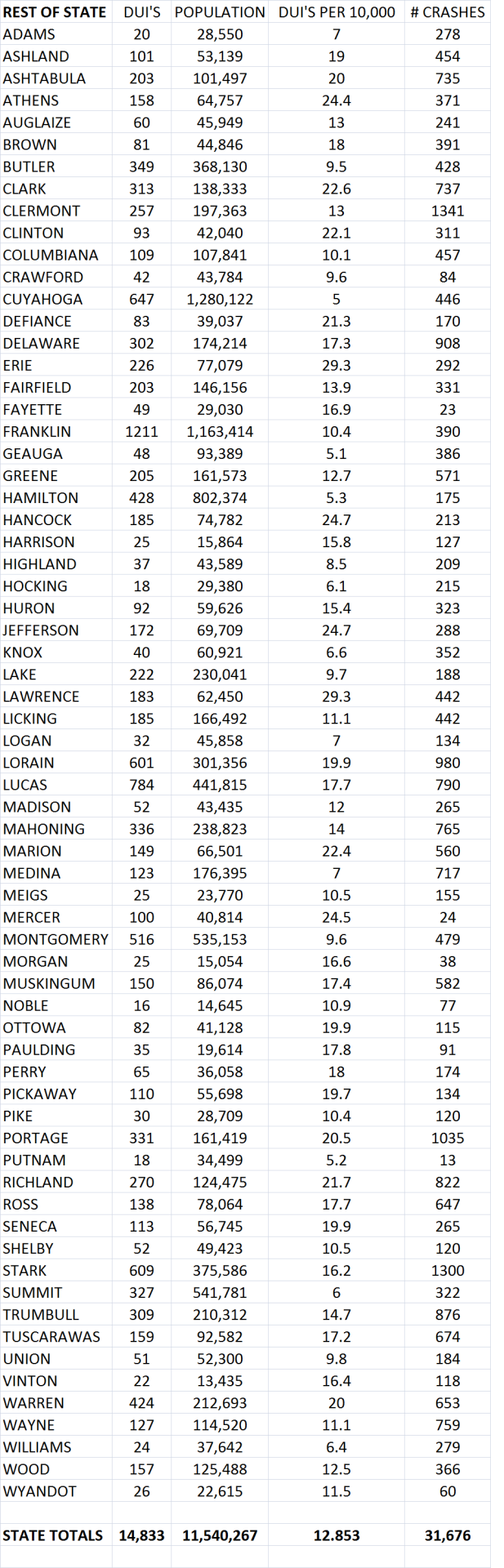

Rest of State What conclusions can be drawn from these stats?

There’s really no earth shattering revelation that can be concluded here. However, people who live in counties that are passing through gateways to other areas tend to have the most traffic, most crashes and most enforcement per capita than other counties. Some people may argue that some counties get picked on more than others, but the stats don’t reflect that. As we saw from the lowest 10 counties, the reason they were ranked the lowest is because they also had very low number of crashes. And with the highest 10 counties, most all of them had high numbers of crashes. So it only makes logical sense of those counties that have the highest number of crashes per capita will experience the most enforcement. Summary: It is always a terrible idea to drive impaired. We all know that. For those of you who live in gateway areas, you have to be extra careful not to get behind the wheel when you are impaired. The best way to combat this problem is to always plan ahead any time you know you’re going to be partying. Having plans for a designated driver go a long way. That will keep you from having to deal with fines, license suspensions, state SR22 filings, and high risk auto insurance agents like me. :) Get an Auto Insurance Quote with Lyles Insurance Call me for a Quote Related Blog Articles: Recent changes to the Ohio BMV's Auto Insurance Random Selection Letter Program  There are many places to buy motorcycle insurance in the Portsmouth Ohio area, whether you buy from an agent, or directly through a motorcycle insurance company. However, most of you probably searched online beforehand. Searching online is the most efficient way to find the best price for the level of coverage you’re looking for…. But there is a right way and a wrong way to shop for motorcycle insurance online. Many bikers screw up by looking in the wrong places. This causes one of two shortcomings: One, you are probably either paying too much for the level of coverage you have, or Two, you could be getting better coverage for the same or nearly the same price. This article will help you understand what to look for and also want to stay away from when shopping online for motorcycle insurance. The dynamics of shopping online for motorcycle insurance It doesn’t matter if you search with Google, Bing, Siri or any other search engine… Most search queries will not land you to the ideal place that you want to be:

Beware of lead generation sites! What is ideal is to visit a local independent agent’s website, and get your quotes from there. However, beware of imposters! Lead generation websites try to look like a regular insurance agency, when in fact they don’t sell insurance at all. They simply collect your quote information and sell it to actual agents as leads. Many of these companies will sell your info to anyone who wants to buy them. This will cause your phone to ring off the hook! Thankfully, there’s a very easy way to tell a real insurance agent’s website from a fake lead generation site…. You simply need to look for the contact information posted on the site, and you will know right away: A real agent will have their name, address and phone number prominently displayed on their website. A fake lead generation site will not have those things. They may copy the look of a real agent’s website, but the local contact info won’t be there because they’re not a real insurance agency. Stay away from those sites! Shopping online with an Independent Agent. Shopping online with an independent agent is your best bet for finding the right motorcycle insurance policy:

Summary: There are several great agents in the Portsmouth Ohio area that can set you up with the right type of motorcycle insurance coverage at an affordable price. The problem is that a lot of people are not reaching them. They’re contacting companies directly instead (or worse, contacting lead factories). This is a trap you don’t want to fall into like many others do. Get a Motorcycle Insurance Quote with Lyles Insurance Call me for a Quote Related Blog Articles: Video: Buyer's guide for buying motorcycle insurance Video: Basics of a Motorcycle Insurance Policy Golf Cart Insurance in Ohio: Don’t get cheated out of great coverage and pay the same price!7/3/2017 There are plenty of companies in Ohio that insure golf carts, but there are no two policies alike when it comes to the coverage being offered. Although just about all golf cart insurance policies are inexpensive, there’s a big difference between a good policy and a lousy one as far as what it covered. Even if you selected the highest coverage available, your policy could still be missing out on important coverage that a good policy offers. Golf cart insurance policies generally fall into two categories: a standalone exclusive golf cart insurance policy, and a golf cart insurance policy that is attached to a homeowners insurance policy. Generally, a standalone exclusive policy offers much better coverage than an attached policy for about the same price. But there are exceptions to both of those. Not all attached policies are bad, and not all standalone policies are good. That’s why it’s important to check to see how well your golf cart insurance policy stacks up versus the better policies. To distinguish between a good golf cart insurance policy and a lousy one, I have come up with key points consisting of both things to look for and also things to avoid. Once you get familiar with these key points, it will be much easier to tell a good golf cart insurance policy from a bad one. So let’s get started. Avoid unreasonable boundary restrictions. As I mentioned before, there are good policies and lousy policies (and there are also some golf cart insurance policies that are really lousy!). Be careful of policies that limit where you are covered on your golf cart. Some policies will not cover your golf cart away from your property. Some policies will not cover your golf cart if you happen to cross a public street and have an accident. And some policies won’t cover you playing golf on a course! How crazy is that? Make sure you stay away from these types of policies that have such restrictions. A good golf cart insurance policy offers much more reasonable coverage. Medical coverage. Like auto insurance, any golf cart insurance policy offers liability coverage and physical damage coverage (comprehensive and collision). But some golf cart insurance policies don’t offer any medical coverage whatsoever if you were to get hurt while driving or riding in your golf cart. A good golf cart insurance policy will offer both medical payments coverage and uninsured motorist bodily injury coverage. Both of those coverages are cheap on a golf cart insurance policy, and they’re more than well worth having. GAP or Total Loss Coverage. This only applies to brand-new or almost brand new golf carts. If your golf cart is new enough to qualify for either gap or total loss coverage, I believe it is a no-brainer, must have coverage! This is especially true if you’re financing your golf cart. Just like cars, once a new golf cart leaves a dealership, it automatically depreciates. GAP or Total Loss Coverage will help prevent you from being under water on a loan if there ever happened to be a total loss. While GAP and Total Loss Coverage have some minor differences, they’re nearly the same. A good golf cart insurance policy will offer of one or the other. Trailer coverage. If you use a trailer to transport your golf cart, it’s also a good idea to add coverage for the trailer as well. The cost to replace a trailer isn’t cheap, but insurance coverage on a trailer is cheap. A good golf cart insurance policy will offer trailer coverage but a lousy one won’t. C

Other things to keep in mind: Do not select levels of coverage with the same mentality as you do auto insurance. Some people simply match levels of coverage on their golf cart insurance that they have on their auto insurance policy. This is a mistake because it can cause you to miss out on some great opportunities. The premium for coverage on an auto insurance policy is not calculated the same way that a golf cart insurance policy is. You’ll find that the price for coverage on a golf cart is much less than the same coverage on an auto policy. Before you select the level of coverage for your golf cart insurance, always inquire on what the next better level of coverage is going to cost. Sometimes you will find that on a golf cart insurance policy, the extra cost for a higher level of coverage can be for peanuts are almost next to nothing. Here are three primary questions you should know the answers to before you buy your policy:

Just by asking those three questions, you may be very surprised at how much better coverage you can get for very little more premium. Road use coverage As you know, golf carts are primarily intended for off road use. However, on occasion you may have to cross a public street. Or you may just want to take a leisurely ride on slow streets in residential areas. That is not a problem with a good golf cart insurance policy. You would be covered for that as long as road use is only occasional. But be sure to look closely at your policy to make sure you do not have any crazy restrictions that would exclude coverage from these types of activities. Coverage for golf carts that are licensed for road use Many small towns are starting to pass ordinances that allow golf carts to be licensed and registered for road use. Once you do this with your golf cart, it becomes a whole different ballgame as far as golf cart insurance is concerned. The bad news is that most golf cart insurance companies will not insure a golf cart that is licensed for road use. So your choices become much more limited…. The good news is that there still are companies who will insure your golf cart even if it is licensed for road use (as long as your cart doesn’t exceed a speed of 20 mph). Fortunately, I was able to find a company that does insure golf carts licensed for road use, and don’t charge extra for it. You just have to look a little deeper. This used to be a very rare problem, but it’s becoming more and more common as more cities continue to pass these ordinances. Summary: It can be very difficult to tell a good golf cart insurance policy from a lousy one. But just by reviewing these points above, you now know what to look for and want to stay away from. For those of you who would like, I will be happy to run you a quote on your golf cart insurance with several of the better companies. And as always, I handle all quotes personally and privately. Get a Golf Cart Insurance quote with Lyles Insurance Call me for a quote Related Blog Articles: Video: Tips for buying Golf Cart Insurance Video: Progressive Golf Cart Insurance Video: Basics of a Golf Cart Insurance Policy Golf cart insurance: 6 Key things you need to know before buying |

Author

Dan Lyles is an Independent Insurance Agent serving Ohio, Indiana, Michigan, Pennsylvania, Virginia and West Virginia.. Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed