|

For drivers in the state of Indiana that need to buy auto insurance but do not own a vehicle, you're going to need to take out what is called a Named Operator Auto Insurance policy (a.k.a. non-owners policy). There are three primary reasons why someone who does not own a vehicle would want or need to carry liability auto insurance:

What a named operator policy covers:

What a named operator policy does NOT cover:

Named operator policy and state filings (SR22 & SR50) In the state of Indiana, for drivers that need an SR22 or SR50 filing, both of these can be easily attached onto a named operator policy. Substitution factor

You will find that most auto insurance companies do not offer SR50 filings. The state of Indiana is the only state that has SR50 filings. But the SR50 filings are slowly being phased out…. Soon, Indiana will only have SR22 filings… But the good news is that you can substitute an SR22 filing in place of it. However, this substitution does not work in reverse. If you need an SR22 filing, you have to go with an SR22. You cannot substitute an SR50 for it because an SR22 has a higher standard than an SR50. So the substitution only works one way. For most of you that's not going to matter anyways because just about all high-risk auto insurance companies only offer the SR22 filing. Buying a named operator policy now and buying a vehicle later on. This situation comes up quite often. You need to buy auto insurance now but don't own a vehicle, but you plan on buying a vehicle real soon. I've had this happen quite often with many of my customers. The good news is that it's a real easy thing to take care of. All it takes is a five minute phone call to your agent. Just about any auto insurance company that offers named operator policies will allow you to convert your named operator policy to a regular auto insurance policy simply by adding a vehicle to it. Your policy number doesn't change, your SR22 or SR50 status doesn't change. The only thing that changes is the coverage and the premium, because now you're insuring a vehicle. Having two separate auto insurance policies. One option that many drivers choose is to carry two separate auto insurance policies: a regular auto insurance policy to insure their vehicle(s) and a named operator policy to satisfy their SR22/SR50 requirement. For a small percentage of people this is a good idea. Especially those who have a good to excellent credit rating, own their home, and have their auto insurance policy bundled with their homeowners insurance policy. But for just about anyone else, it comes out cheaper to combine everything onto one policy. Finding the best rate. Here is where it can get tricky. Many auto insurance companies do not even offer named operator policies. So you may have to look a little deeper down the list to find the right company for you. Your best bet for finding the best rate would be to contact an independent agent who specializes in high-risk auto insurance. It just so happens that high risk companies usually end up offering the best rates on named operator policies. Regardless of your driving record. Summary: For some people a named operator policy is a good idea. For others it may not work for you. I hope that this article will at least give you enough information to where you can make that determination for yourself. If you have any other questions, feel free to give me a call or drop me an email and I'll be happy to answer any questions you have. If you would like a quote for a named operator policy click on the link below and I will find you the company with the lowest rate. Get a Named Operator Auto Insurance Quote with Lyles Insurance Call me for a Quote Related Blog Articles: Video: Guide to getting Indiana SR22 Non-owner SR22 Quotes Video: Basics of a Named Operator Policy Video: Named Operator Auto Insurance with an SR22 Filing Video: Buyer's Guide: Indiana SR50 Auto Insurance What's the difference between an Indiana SR50 and an SR22 auto insurance filing? The difference between an Indiana SR50 and an SR22 auto insurance filing?

4 Comments

When it comes to boat insurance in Virginia, it would be very difficult to find two policies exactly alike. Boat insurance policies can range from very good to very lousy as far as coverage is concerned. Without knowing what to look for, it’s nearly impossible to distinguish between a good boat insurance policy and a bad one. This article will offer you 10 key points on what to look for on a boat insurance policy. Not all 10 key points will apply to everyone. But this will give you a good understanding of knowing how to tell how well your current boat insurance policy stacks up against other boat insurance policies. One recurring thing you will notice deals with how you have your boat insurance policy set up. Generally speaking, an exclusive standalone boat insurance policy usually offers much better coverage than a boat insurance policy that’s attached onto a homeowners insurance policy. So if you have your boat insured under your homeowners policy, you’ll want to take a close look it at this. Chances are that you could be getting much better coverage for about the same price. So here are 10 key points that will help you distinguish between a good boat insurance policy and a bad one: 1. Agreed value coverage vs. actual cash value coverage. A good boat insurance policy will insure your boat on an agreed value coverage basis. This coverage is far better than having your boat insured on actual cash value basis, which factors in depreciation and market value. There is a huge difference between what the two will pay out in the event of a total loss to your boat. So make sure your boat is insured on an agreed value basis. 2. Gap coverage or total loss coverage. This only applies if you have a brand-new boat or a boat that’s almost brand new. Some boat insurance companies will offer gap coverage, some will offer total loss coverage. But if you have a new or newer boat, it is very wise to select whichever of the two coverages are offered. Gap coverage and total loss coverage are almost the same thing. Both of them help protect you from becoming upside down on a loan in the event of a total loss. So if you’re financing your boat, it is very important to select either gap or total loss coverage, whichever the company offers. 3. Beware of unreasonable restrictions. If you read the fine print of your boat insurance policy, be sure to look for coverage exclusions that are unreasonable. Here are just a couple examples:

4. Accessory coverage. Just about every boat has some type of accessory equipment attached to it. This includes things such as navigation equipment, lighting, stereo equipment etc. Much of this equipment is very expensive, but can be insured for a very low price. A lousy boat insurance policy will not offer coverage on accessories. However, a good boat insurance policy will not only offer accessory coverage but in many cases, will also offer coverage for free up to a certain amount (as long as you are carrying comprehensive and collision coverage). You can also purchase higher amounts of coverage if you want with most companies as well. 5. Personal Property coverage. Equipment that is not attached to your boat can be just as expensive, but yet very inexpensive to insure…. This includes things like safety equipment, ski’s, tubes, fishing equipment etc. A good boat insurance policy will offer personal property coverage. And the coverage vs. the cost is very well worth it. R6. Trailer coverage. Almost all boats require a trailer to transport it. Again, this coverage is very well worth looking into. Trailers aren’t cheap either. But trailers are like accessories and personal property, in that the amount of premium to insure them is very low. 7. Liability coverage for fuel spillage and debris removal. All boat insurance policies include liability coverage. But most policies will only pay out for injuries and property damage as far as liability coverage is concerned. But many areas will hold you responsible for the cost of fuel spillage and debris removal if you’re to cause an accident. Only a good boat insurance policy will include fuel spillage and debris removal as part of their liability coverage. 8.Uninsured motorist bodily injury coverage and medical payments coverage. While these are both primary coverages on an auto insurance policy, a lousy boat insurance policy will not offer either of these coverages. Medical payments coverage will cover injuries for you and your passengers in a boating accident regardless of who was at fault. Uninsured motorist coverage will kick in if another boater causes an accident with you and they don’t have liability boat coverage like they should be carrying. 9. Pay attention to your mileage limits. A good boat insurance policy is usually pretty lenient regarding how far you can take your boat and still be covered. However, there are some bad boat insurance policies out there that have unreasonable mileage restrictions. So make sure you review that on your boat insurance policy, and that you’re covered as far as you want to take your boat. 10. Roadside assistance coverage. Boats break down more often than automobiles do. Thus it’s a really good idea to carry roadside assistance coverage for your boat. Look closely at what is covered and look at the cost of coverage. More often than not, it is very well worth it to have roadside assistance coverage. Bonus Tip: Safety course discount. I usually do not recommend taking a safety course for the sole reason of getting a discount on insurance because the cost of the course is usually higher than the amount of money you will save. But in Virginia, boaters are required by law to take a safety course. So therefore you might as well take advantage of it if your boat insurance company offers such a discount. Summary: This is not an all-inclusive list. But it will give you a good idea of knowing what to look for and what to avoid regarding a boat insurance policy… If you find that your boat insurance policy isn’t all that good as you thought it was, it may be time to shop around for other boat insurance. Chances are that you can get much better coverage for the same, or about the same price. Get a Boat Insurance Quote with Lyles Insurance Call me for a Quote Related Blog Articles: Video: 10 Additional Coverages offered on a good Boat Insurance Policy Video: Progressive Boat Insurance Video: What you need to know before you buy Boat Insurance Pennsylvania is one of very few states that offer the option of having stacked or unstacked coverage on an auto insurance policy. However, not many people understand the difference between the two. This article will help you understand how stacked auto insurance coverage works, and answer other questions you may have.

Who does Stacked coverage apply to? Stacked coverage applies to anyone with a PA auto insurance policy that has more than one vehicle insured on that policy. What coverage does having the Stacked option refer to? Stacked insurance applies to Uninsured and Under-Insured Motorist Bodily Injury Coverage. Uninsured Motorist coverage (UMBI) applies when you are hit and injured by a driver that is not carrying auto insurance like they’re supposed to have. Under-Insured Motorist coverage (UIMBI) applies when you are hit and injured by a driver that has auto insurance, but is not carrying enough liability coverage to pay for all of your injuries. UMBI is important coverage to have because 1 in every 6 drivers are driving uninsured. UIMBI coverage is just as important because out of the drivers that do have auto insurance, many of them carry very low levels of liability coverage. How does Stacked coverage work? If you choose the Stacked option on your auto insurance policy, the amount of UMBI & UIMBI coverage that you selected is multiplied by the number of vehicles you have insured. Example: Let’s say you chose a level of 100/300 for UMBI & UIMBI coverage (100/300 is represented in 1000’s), and you selected the Stacked option…..

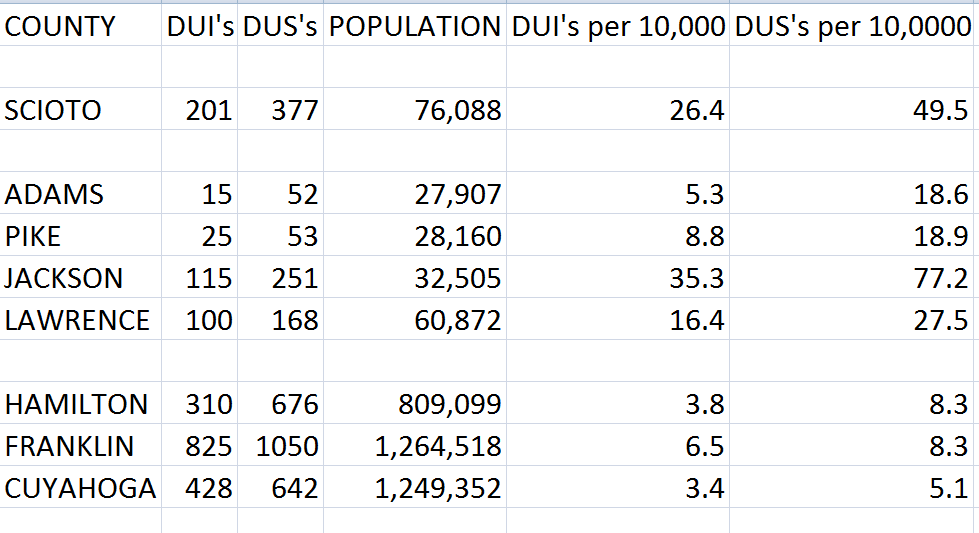

Wouldn’t I come out the same if I simply chose the Un-stacked option, and multiplied the initial level of coverage by my number of insured vehicles? No. For three reasons: 1. Dollar for dollar, it usually comes out significantly cheaper to go with the Stacked option than going with the Un-stacked option and multiplying initial levels of coverage…. With some companies, it comes out a lot cheaper. 2. Remember that you are limited on the initial level of UMBI & UIMBI coverage that you choose. By law, you cannot select a higher initial level of UMBI or UIMBI coverage than the level you selected for Liability bodily injury coverage. So if you only selected 100/300 for your Liability bodily injury coverage, that’s as high as you can choose for your initial levels of UMBI & UIMBI coverage. So increasing UMBI & UIMBI levels would mean you would have to simultaneously increase your liability coverage. 3. Many auto insurance companies won’t offer high enough levels of liability and/or UMBI & UIMBI coverage to get you up to the level that the stacked option can… The more vehicles you have insured, the more likely this is true. I only own one vehicle now, but plan on buying a 2nd vehicle soon. Will I be able to change my status to Stacked once I buy a second vehicle? Certainly. With a simple 3 minute phone call to your agent, it is very easy to both add a vehicle and update your status to stacked on your auto policy. It's very easy to switch back and forth at any time. Summary: For those of you who have multiple vehicles insured on an auto policy, selecting the stacked option is a great idea! The cost is usually very low, and it’s well worth multiplying your levels of UMBI and UIMBI coverage. The percentage of drivers that drive uninsured and under-insured have become a serious risk to other drivers… Stacking is a very cost effective way to lower that risk. Get a PA Auto Insurance Quote with Lyles Insurance Call me for a Quote Related Blog Articles: Video: Factors used in calculating Auto Insurance Rates A high percentage of people in the Portsmouth Ohio area are required by the state BMV to carry SR22 auto insurance filings to reinstate and keep their driver’s license active. That’s because Scioto County has a very high rate of DUI’S and driving under suspensions (DUS) per capita compared to other counties (see chart below). Only our neighbors in Jackson County and very few others of Ohio’s 88 counties have a higher percentage than Scioto County. Having a DUI or DUS charge is two of the three most common reasons that a driver would be required to carry an SR22 filing with the BMV. Having an SR22 filing is usually the last, or one of the last steps that you need to take before you get your driver’s license reinstated. However, there’s a lot of confusion about how to go about getting an SR22 filing. What’s even more confusing is the fact that a common frequently used term “SR22 bond” is very misleading. An SR22 filing isn’t a bond or auto insurance at all. So to help clear up some of this confusion, I’ve created a list of frequently asked questions regarding SR22 filings. This will answer key questions so that you’ll know how to set up an SR22 properly for your needs. So let’s begin: What is an SR22? As I mentioned before, an SR22 isn’t insurance or a bond at all. It is a state filing that attaches onto either regular auto insurance or a Financial Responsibility Bond (FRB). The best way to understand it is to think of an SR22 as a “tattletale”. It is a guarantee to the state BMV that you’re keeping active auto insurance with at least state minimum levels of liability coverage….. For the time period that you have to carry the SR22, you need to keep your policy active….. If your policy would happen to lapse, expire or cancel, the auto insurance company is required by law to notify the state BMV….. Once that happens, your license will be suspended again until you put another policy in place with an SR22 attached. What is a Financial Responsibility Bond (FRB)?

How should I set up an SR22 filing?

How do I file the SR22 with the Ohio BMV? Once you pay for a policy with an SR22 attached, the auto insurance company will file the SR22 electronically to the state BMV. You also have the option of taking the paperwork to the BMV yourself but it isn’t necessary unless you’re in a hurry, and need your license reinstated that day. How long does it take for coverage to go into effect? Once you pay the down payment or full payment on a policy, the auto insurance coverage that you selected goes into effect right away. However, if you need an SR22 and the company files it electronically to the BMV, it usually takes the BMV about one business day for the SR22 to process. Can I pay for two separate policies, having regular auto insurance to insure my vehicle(s), and having a financial responsibility bond just to satisfy my SR22 requirement? Yes, this is perfectly fine to do. However, for about 90% of the population, it’s the more expensive way to handle both problems. For the vast majority of people, it’s cheaper just to combine both the auto insurance and the SR22 filing together onto one regular auto insurance policy. But there are some exceptions to this. Sometimes it makes good financial sense to carry two separate policies. This is especially true if you are a homeowner with a good to excellent credit rating, and have your auto insurance bundled with your homeowner’s policy. I own a vehicle but can’t afford regular auto insurance… Can I carry a Financial Responsibility Bond instead of buying regular auto insurance? Legally, as long as you’re the only person that drives the vehicle, it’s ok to do…. BUT THIS IS A VERY BAD IDEA!!! I strongly discourage it for the following reasons:

How long do I need to carry an SR22 filing? For most drivers, the SR22 filing requirement lasts three years. However, there are situations in which that time requirement could be more or less. You can easily look up this information for free on the Ohio BMV’s website. Just click on the link for a copy of your “unofficial driving abstract” (the official abstract will have this info as well, but will cost a few bucks). Where’s the best place to find either Auto Insurance or an FRB with an SR22 attached? This is where it gets tricky! Most auto insurance companies only sell regular auto insurance policies, and don’t offer Financial Responsibility Bonds at all. Many auto insurance companies also don’t allow SR22 filings. Many other auto insurance companies do allow SR22 filings, but they will charge an arm and a leg for it! The key is to find those few auto insurance companies that go easier on drivers with bad driving records and SR22 filing requirements. Your best chance of doing that is with an independent insurance agent who specializes in high risk auto insurance. That way, you can shop around with several SR22 friendly companies at once. Summary: For those of you who need an SR22 filing, you have a big advantage in knowing the info above as far as finding the right policy at the lowest price. If you still have any questions, feel free to give me a call at 740-574-2618. I will be happy to answer any questions you have. If you would like a quote, click on one of the two links below. Get a Regular Auto Insurance quote with Lyles Insurance Get a Financial Responsibility Bond quote with Lyles Insurance Call me for a Quote Related Blog Articles: Video: Basics of an Ohio Financial Responsibility Bond Video: Ohio SR22 Bond FAQ's How much does SR22 bond insurance cost in Ohio? How long will it take for my License to be Reinstated after I buy an Ohio SR22 Bond? While boat insurance is very easy to find, it is sometimes difficult to tell a good boat insurance policy from a bad one. Unlike auto insurance, which is for the most part standardized, it's rare to find two boat insurance policies exactly alike. For the most part, stand-alone boat insurance policies generally offer much better coverage for about the same price as opposed to boat insurance that's attached to a homeowners policy. This is especially true in Michigan, where there are not as many companies who offer stand-alone coverage. So I’ve compiled this list of 10 key points to look for on the boat insurance policy. This is basically a combination of both things to look for and things just to stay away from. It’s not an all inclusive list, but it will give you a good understanding of knowing the difference between a good boat insurance policy and a bad policy. So let’s get started: 1. No crazy restrictions. Some boat insurance policies have strict limitations about where a boat is moored or how it can be used. You need to make sure your boat insurance policy doesn't have any silly restrictions. For examples:

I’ve seen other silly restrictions on other policies, but those are the two most common. So be sure to take a good look for any exclusions or restrictions on your policy. 2. Agreed Value Coverage versus Actual Cash Value (ACV) coverage. A boat insurance policy is going to be insured one way or the other. But the difference is huge! Agreed value coverage is far better than actual cash value coverage. Agreed value coverage represents the total amount that your boat is insured for in case of a total loss. Actual cash value coverage only insures your boat for its market value. Market value takes into account depreciation. That's why having Agreed Value coverage is very important. 3. Gap or total loss coverage. This only applies to boats that are brand-new or almost new. But this loss can be huge if you don't have the right coverage. Gap or total loss coverage prevents you from becoming upside down, if you finance your boat. The extra cost is usually very minimal and is not only very well worth it, it’s a must have! With most companies that offer either GAP or Total Loss coverage, a boat with a model year less than two years is qualified. 4. Trailer coverage. Almost any boat owner also has a trailer that you transport your boat with. Why not have insurance on the trailer as well? What you'll find is that insurance coverage on trailers that haul boats is usually cheap and well worth the price. 8. Uninsured motorist and medical payments coverage. You’re probably familiar with these terms from dealing with auto insurance. They work exactly the same for boat insurance, only that some boat insurance policies don’t offer either coverage at all. Medical payments coverage will help pay for any injuries you or your passengers sustained from a boating accident regardless of who was at fault. Uninsured motorist coverage will protect you if another boater causes the accident and is not carrying liability coverage. Once again, a good boat insurance policy will offer both of these coverages, a bad policy will not. 9. Reasonable mileage limits. Be sure to read the fine print on your boat insurance policy as far as how far you can go with your boat and still be covered. A good boat insurance policy won’t carry unreasonable restrictions that a bad boat insurance policy will. A good boat insurance policy will offer reasonable mileage limits, with the option to purchase farther limits if you need it. 10. Roadside assistance. Many boat insurance policies that are attached to a homeowners policy don’t have roadside assistance coverage offered. For boat insurance companies that do offer coverage, the difference between what is covered and what is not varies greatly from one company to the next. So again, you need to read the policy and see exactly what your boat insurance company offers for roadside assistance coverage. In most cases, selecting this coverage is well worth the very small premium that usually comes with it. Summary: You have to look closely at what is covered and what's not on your boat insurance policy. Boat insurance policies are much like snowflakes, and that no two are exactly alike. This list will help you understand what coverage you should have, and also make you aware of extra coverages you should be offered. Get a Boat Insurance quote with Lyles Insurance Call me for a Quote Related Blog Articles: Video: 10 Additional Coverages offered on a good Boat Insurance Policy Video: Progressive Boat Insurance Video: What you need to know before buying Boat Insurance |

Author

Dan Lyles is an Independent Insurance Agent serving Ohio, Indiana, Michigan, Pennsylvania, Virginia and West Virginia.. Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed