|

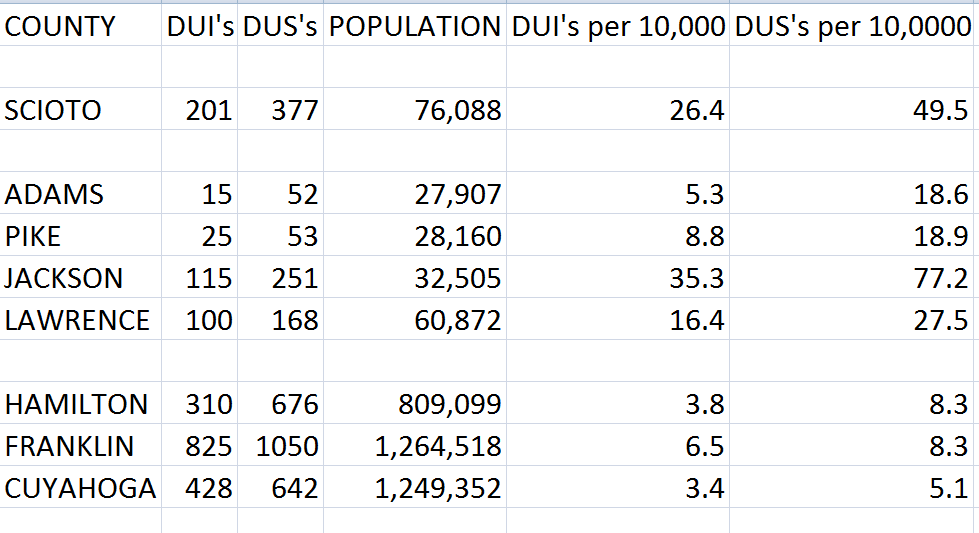

A high percentage of people in the Portsmouth Ohio area are required by the state BMV to carry SR22 auto insurance filings to reinstate and keep their driver’s license active. That’s because Scioto County has a very high rate of DUI’S and driving under suspensions (DUS) per capita compared to other counties (see chart below). Only our neighbors in Jackson County and very few others of Ohio’s 88 counties have a higher percentage than Scioto County. Having a DUI or DUS charge is two of the three most common reasons that a driver would be required to carry an SR22 filing with the BMV. Having an SR22 filing is usually the last, or one of the last steps that you need to take before you get your driver’s license reinstated. However, there’s a lot of confusion about how to go about getting an SR22 filing. What’s even more confusing is the fact that a common frequently used term “SR22 bond” is very misleading. An SR22 filing isn’t a bond or auto insurance at all. So to help clear up some of this confusion, I’ve created a list of frequently asked questions regarding SR22 filings. This will answer key questions so that you’ll know how to set up an SR22 properly for your needs. So let’s begin: What is an SR22? As I mentioned before, an SR22 isn’t insurance or a bond at all. It is a state filing that attaches onto either regular auto insurance or a Financial Responsibility Bond (FRB). The best way to understand it is to think of an SR22 as a “tattletale”. It is a guarantee to the state BMV that you’re keeping active auto insurance with at least state minimum levels of liability coverage….. For the time period that you have to carry the SR22, you need to keep your policy active….. If your policy would happen to lapse, expire or cancel, the auto insurance company is required by law to notify the state BMV….. Once that happens, your license will be suspended again until you put another policy in place with an SR22 attached. What is a Financial Responsibility Bond (FRB)?

How should I set up an SR22 filing?

How do I file the SR22 with the Ohio BMV? Once you pay for a policy with an SR22 attached, the auto insurance company will file the SR22 electronically to the state BMV. You also have the option of taking the paperwork to the BMV yourself but it isn’t necessary unless you’re in a hurry, and need your license reinstated that day. How long does it take for coverage to go into effect? Once you pay the down payment or full payment on a policy, the auto insurance coverage that you selected goes into effect right away. However, if you need an SR22 and the company files it electronically to the BMV, it usually takes the BMV about one business day for the SR22 to process. Can I pay for two separate policies, having regular auto insurance to insure my vehicle(s), and having a financial responsibility bond just to satisfy my SR22 requirement? Yes, this is perfectly fine to do. However, for about 90% of the population, it’s the more expensive way to handle both problems. For the vast majority of people, it’s cheaper just to combine both the auto insurance and the SR22 filing together onto one regular auto insurance policy. But there are some exceptions to this. Sometimes it makes good financial sense to carry two separate policies. This is especially true if you are a homeowner with a good to excellent credit rating, and have your auto insurance bundled with your homeowner’s policy. I own a vehicle but can’t afford regular auto insurance… Can I carry a Financial Responsibility Bond instead of buying regular auto insurance? Legally, as long as you’re the only person that drives the vehicle, it’s ok to do…. BUT THIS IS A VERY BAD IDEA!!! I strongly discourage it for the following reasons:

How long do I need to carry an SR22 filing? For most drivers, the SR22 filing requirement lasts three years. However, there are situations in which that time requirement could be more or less. You can easily look up this information for free on the Ohio BMV’s website. Just click on the link for a copy of your “unofficial driving abstract” (the official abstract will have this info as well, but will cost a few bucks). Where’s the best place to find either Auto Insurance or an FRB with an SR22 attached? This is where it gets tricky! Most auto insurance companies only sell regular auto insurance policies, and don’t offer Financial Responsibility Bonds at all. Many auto insurance companies also don’t allow SR22 filings. Many other auto insurance companies do allow SR22 filings, but they will charge an arm and a leg for it! The key is to find those few auto insurance companies that go easier on drivers with bad driving records and SR22 filing requirements. Your best chance of doing that is with an independent insurance agent who specializes in high risk auto insurance. That way, you can shop around with several SR22 friendly companies at once. Summary: For those of you who need an SR22 filing, you have a big advantage in knowing the info above as far as finding the right policy at the lowest price. If you still have any questions, feel free to give me a call at 740-574-2618. I will be happy to answer any questions you have. If you would like a quote, click on one of the two links below. Get a Regular Auto Insurance quote with Lyles Insurance Get a Financial Responsibility Bond quote with Lyles Insurance Call me for a Quote Related Blog Articles: Video: Basics of an Ohio Financial Responsibility Bond Video: Ohio SR22 Bond FAQ's How much does SR22 bond insurance cost in Ohio? How long will it take for my License to be Reinstated after I buy an Ohio SR22 Bond?

0 Comments

Leave a Reply. |

Author

Dan Lyles is an Independent Insurance Agent serving Ohio, Indiana, Michigan, Pennsylvania, Virginia and West Virginia.. Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed