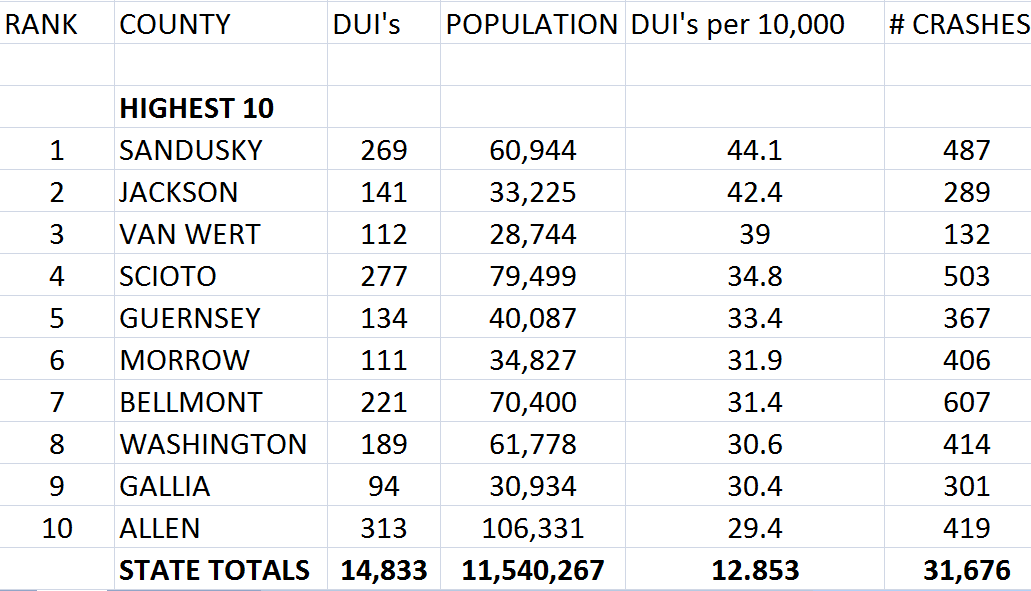

A high percentage of drivers in the Portsmouth Ohio area are required to carry an SR22 filing attached onto their auto insurance policy. Getting an SR22 is usually the last step a driver needs to take before getting a suspended driver's license reinstated. Keeping an SR22 filing active is also what keeps a license active during the time that drivers are required to carry an SR22 filing. However, I’ve noticed that many drivers attach their SR22 to the wrong type of policy. This article will help you understand what you need to know as far as setting up the right type of policy, how to look for the lowest rate, and also answer some frequently asked questions. If it seems like the Portsmouth Ohio area and Scioto County in general has an unusually high rate of driver’s who need an SR22 filing, you may have a point.

Confusion about SR22’s Before we begin with how to properly set up an SR22 filing, let me help clear up some confusion about SR22 filings. The terminology many people use causes confusion:

What does an SR22 filing do? The best way to understand what an SR22 filing does is to think of it as a “Tattle-tale”. It lets the state BMV know that you have taken out some type of auto insurance liability coverage with at least state minimum limits of liability coverage. This is what triggers your license to be reinstated (assuming you have also met all other reinstatement requirements)….. However, if you ever cancel or lapse on a policy with an SR22 attached, the auto insurance company is required by law to “tattle” on you to the BMV. The BMV will then suspend your license again until you either reinstate your policy, or start another policy with an SR22 attached. Setting up your SR22 filing the right way. This is very important! I’ve seen a lot of people screw up on this step, and set up their policy the wrong way. However, setting up your policy the correct way is actually very easy to do just by keeping things simple:

That’s all there is to it! As long as you follow this, you know that you have set your policy up properly. Vehicle owners will still have to make important choices regarding the levels of coverage they carry on their regular auto insurance policy. But at least this important first step will have your policy structured the right way. FAQ’s My neighbor has to carry an SR22 filing and he owns a vehicle…. He only carries a Financial Responsibility Bond for both his SR22 filing requirement and coverage for his vehicle, instead of having a regular auto insurance policy….. Is this ok to do? As far as driving legally, yes, it is OK to do. But it is something that I would strongly discourage! A financial responsibility bond is very lousy coverage for a vehicle owner to carry. I know a lot of drivers that do it this way because it is significantly cheaper than having regular auto insurance. But there’s a valid reason why it’s cheaper. The coverage is inadequate for a vehicle owner:

Is it ok to have two separate policies, a regular auto insurance policy to insure my vehicle(s), and a Financial Responsibility Bond to satisfy my SR22 filing requirement? Yes, this is fine to do. And it’s a good idea for a small percentage of people to do so…. But for the vast majority of you, it is usually less expensive to have everything on one regular auto insurance policy. However, it sometimes make good sense to have separate policies if you are a homeowner, have good to excellent credit, and have your auto insurance bundled with your homeowners policy. How long do I need to carry an SR22 filing? For most of you, the requirement period is usually three years. But it can be more or less, especially if it was a court ordered SR22 filing…. To know exactly when your SR22 requirement period expires, you can look that info up for free on the Ohio BMV website (pull up your “unofficial driver abstract”). It’s important that you keep that expiration date in mind. If you detach your SR22 filing too early, your license will be suspended… If you detach your SR22 filing too late, you could be paying extra for needless filing fees. Where’s the best place to look for SR22 insurance? This part can be a bit frustrating because many auto insurance companies won’t write SR22 filings…. Other auto insurance companies will write SR22 attachments, but charge a fortune for it….. Your best bet is with an independent agent who specializes in high risk auto insurance. The companies that they carry tend to be the companies that are more SR22 friendly. One quote with an independent agent can get you quotes from several companies at once. Get an SR22 Quote with Lyles Insurance here if you own a vehicle Get an SR22 FR Bond quote with Lyles Insurance here if you do not own a vehicle. Call me for a Quote Related Blog Articles: Video: How SR22 State Filings work with Auto Insurance Video: Finding Affordable Auto Insurance with a DUI Recent changes to the Ohio BMV's Auto Insurance Random Selection Letter Program

1 Comment

6/14/2019 03:26:27 pm

I wasn't aware that getting SR-22 auto insurance is crucial for my license active. If I were to choose, I think I will go to an insurance company to help me get the right policy for my situation. Since I don't own a vehicle yet, it would help if they can help me file so that I can finally buy a car.

Reply

Leave a Reply. |

Author

Dan Lyles is an Independent Insurance Agent serving Ohio, Indiana, Michigan, Pennsylvania, Virginia and West Virginia.. Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed