|

There are several major factors that way and to calculate your auto insurance premium. One of those major factors is your driving record. As you probably know, someone with a clean driving record is usually going to pay less for auto insurance versus someone who has accidents or violations on their record. The real question is How much does a violation increase your auto insurance premium? There are many variables that go in to calculating auto insurance rates. There's no way to give a specific one-size-fits-all answer regarding how much a violation affects car insurance premiums. And while there are hundreds if not thousands of different auto insurance companies, and all of them do their own thing when it comes to how they rate violations. In general, most auto insurance companies fall in one of two categories: the first category are the standard/preferred companies. The second category are the nonstandard/high-risk companies. You'll find out that there is a huge difference in how these two categories vary as far as penalizing drivers for having violations on their record. Standard and preferred companies almost always punish drivers more severely for violations than what nonstandard high-risk companies do. "I have a _______ violation on my record. How much will this raise my auto insurance premium?" Knowing that nonstandard companies go easier on violations versus standard companies helps narrow the choices down somewhat. But this is still a tough question to answer..... WHY? ...... Because even with nonstandard companies, there's a lot of variance between each company, and how they treat each violation differently. How much differently? ...... I decided to do some research on that using real-life actual quotes and compare the dollar amount differences between certain violations. I compared how much more that different violations cost on your auto insurance premium versus what it would cost for someone with a clean driving record, with all other things being equal. How the case study was done.

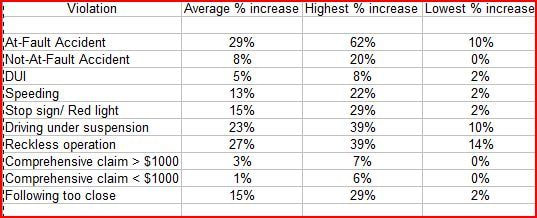

What this data shows

As an example: Let's say that I have a clean record, and I get quoted at $100 per month with all four companies. If I then take that same quote and add an at-fault accident to my record (without changing anything else), the average price between the four companies would be $129. But with that same violation, I could pay as much as $162, or as little as $110. So Here it is..... Notes about Violations:

How long do violations affect my insurance rate? Some companies go back as far as five years, but other companies only go back three years. The majority of nonstandard companies only go back three years. Many of the companies that go back five years lessen the severity after three years (so it still counts, but doesn't affect your premium as bad). Common violations not listed above I did not include failure to yield or failure to control violations because they're normally accompanied by an at-fault accident, so only the at-fault accident would count against you.... I also didn't include seat belt tickets. Some companies count seat belt tickets, some don't. three of the four companies I used in this case study do not count seat belts. So there wasn't enough data to include it into the study. Conclusions from this case study

If you live in Ohio, Indiana, Michigan, Pennsylvania, Virginia or West Virginia and would like help finding a lower auto insurance rate, click on the link below, and I'll be happy to run a quote for you.... And as always, I handle all quotes personally and privately. Get an Auto Insurance Quote with Lyles Insurance Call me for a Quote Related Blog Articles Video: 13 Deadliest Driving Behaviors Help! A Vin Number mismatch is causing a snag in buying Auto Insurance The Basics of an Auto Insurance Policy: Breakdown of each coverage explained Right Way and Wrong Way to Cancel Auto Insurance Policies when Switching Companies Understanding named operator (non-owner) auto insurance policies and how to get the best rate

0 Comments

Leave a Reply. |

Author

Dan Lyles is an Independent Insurance Agent serving Ohio, Indiana, Michigan, Pennsylvania, Virginia and West Virginia.. Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed