|

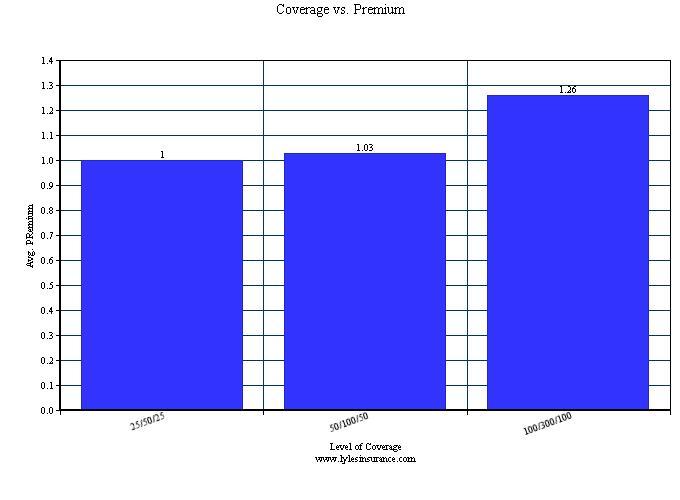

In order to save money, many people choose to skimp on their auto insurance liability coverage, and go with the lowest limits that their state will allow. As I have preached to people countless times, this is a very bad idea! But no matter how hard an agent tries to get the point across, not too many listen. So, I decided to do a case study on auto insurance liability coverage to see just how much an increase in coverage raises auto insurance premiums. So for my case study, Here's what I did:

Key Finding: Significantly increasing liability coverage only amounted to pennies on the dollar more in premium.

Notes about the case study:

Summary: When considering low levels of liability coverage, hopefully this case study will make you think twice, and finally sink in. Doubling liability coverage only amounted to about 3 cents on the dollar, and taking even higher levels only amounted to about a quarter on the dollar. As I've mentioned before, state minimum liability coverage (no matter which state you live in) is lousy! These small increases in premium are well worth the higher coverage that you get for it. Also keep in mind that Uninsured Motorist (UM) coverage is very important, and it is limited to the amount of liability coverage you select. So if you go skimpy on liability coverage, you force yourself to go skimpy on UM coverage as well. Get an Auto Insurance quote with Lyles Insurance Call me for a Quote Related Blog Articles: The Basics of an Auto Insurance Policy: Breakdown of each coverage explained

0 Comments

Leave a Reply. |

Author

Dan Lyles is an Independent Insurance Agent serving Ohio, Indiana, Michigan, Pennsylvania, Virginia and West Virginia.. Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed