|

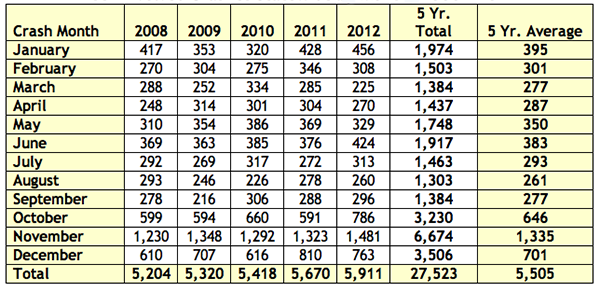

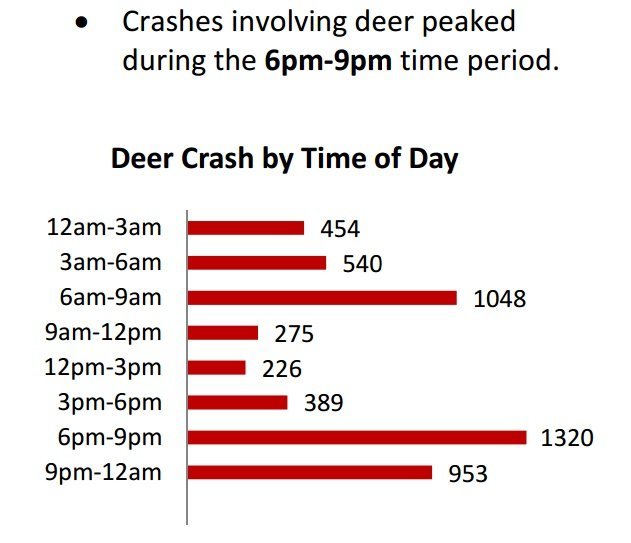

Autumn is the peak of collisions involving vehicles and deer, with November being the peak month. Thus there's no better time to review your auto insurance coverage than now. Comprehensive coverage is the part of auto insurance that covers you in case you were to hit a deer. In the event you do hit a deer, comprehensive coverage will pay for the damage up to the value of the vehicle minus whatever deductible you're carrying. For people with newer and more expensive vehicles, or vehicles that are financed, you more than likely already have this coverage on your policy. But for those who do not have comprehensive and collision coverage (meaning they're only carrying a liability policy), there is no coverage for your vehicle if you were to hit a deer. Although I am not fond of the term because it's somewhat misleading, people refer to having comprehensive and collision coverage together as "full coverage". For people with older vehicles that have less value, it is quite common for drivers to pass on the comprehensive and collision coverage and only carry the required liability coverage. However if you want to be protected by deer without having the cost of carrying full coverage, there is some middle ground that you might want to look into. Another Option: Choosing comprehensive coverage without collision coverage. I would guess that with over 90% of the auto insurance policies I see, customers either carry both comprehensive and collision coverage or they carry neither one. A lot of people are not aware of the fact that you can get comprehensive coverage without collision coverage. While this is a little more expensive than just carrying liability coverage, it is not as expensive as carrying full coverage. That is because you are declining to take collision coverage which tends to be more expensive than comprehensive coverage in most instances. (*note: not all auto insurance companies allow customers to do this, but the majority of them do) So choosing comprehensive coverage without collision collision coverage will not help you with your vehicles in an accident, but it will cover you if you hit a deer. For those who only have liability coverage, I have seen quotes were adding just comprehensive coverage doesn't increase premium that much more. It may be affordable enough to where you should seriously consider the extra coverage. By saying "affordable", I've seen comprehensive coverage range anywhere from as low as an extra five dollars a month. But for most older vehicles with lesser value adding comprehensive coverage usually only raises the rate by around $10 a month. Would you spend an extra $5-10 a month to have peace of mind knowing that if a deer ran out in front of you, you would be covered? This idea isn't for everyone. Some are you some of you are going to need collision coverage in addition to comprehensive coverage. That is either because of the value of the vehicle or if you have it financed through a car loan. But for those of you who are only carrying liability coverage, it's worth it just to get an idea of what it's going to cost. I think many of you will be surprised to see how much little extra it would be. There is one major downside to this strategy of only carrying comprehensive coverage and not collision coverage that you need to be aware of. In the event you hit a deer that goes on comprehensive coverage, so no problem. .... But if you swerve to miss a deer and hit something else that would fall under collision coverage. So let's say you are driving down the highway and a deer runs out in front of you you swerve and miss the deer but hit a tree.... If you go with the strategy of only having comprehensive coverage, it would not be covered. Exclusive Deer Coverage: Rare but becoming more common This is a fairly new component of an auto insurance policy. Most companies haven't yet offered this on their policy. But I believe it be become more common as time goes on. It's sort of like having just a piece of comprehensive coverage.... The deer coverage option allows you to be covered for deer, but does not offer other types of coverage that comprehensive colverage includes. Examples would be theft, fire, vandalism, weather related damage (hail, falling tree) etc. For the companies that offer deer only coverage, it usually only costs less than half of what comprehensive coverage runs. Deer Statistics:

0 Comments

Leave a Reply. |

Author

Dan Lyles is an Independent Insurance Agent serving Ohio, Indiana, Michigan, Pennsylvania, Virginia and West Virginia.. Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed